The blockchain industry is expanding at breakneck speed this year. Unlike the froth of past cycles, 2025’s growth comes from active users. Millions of wallets are transacting across DeFi, NFTs, and gaming platforms.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

From Solana’s lightning-fast memecoin trades to Coinbase’s (COIN) Base onboarding retail investors, networks are competing for the same prize: sustained user activity. Scalability upgrades, stablecoin flows, and mainstream partnerships are giving these chains momentum, though risks remain.

The Top 10 Fastest-Growing Chains in 2025

1. Solana (SOL-USD)

The clear frontrunner with 57 million active users, Solana thrives on DeFi, NFTs, and memecoin mania. Its Firedancer client has improved reliability, but old scars from outages and concerns about centralization continue to weigh on sentiment.

2. Near Protocol (NEAR-USD)

Posting 51.2 million active users, Near’s AI-native tools and ultra-low fees have made it a developer favorite. Sharding complexity and competition from faster rivals could slow its rise.

3. BNB Chain (BNB-USD)

With 46.4 million users, Binance’s chain remains an EVM powerhouse. Faster block times and AI features have boosted adoption, but centralization and regulatory scrutiny are clear risks.

4. Base: Coinbase’s L2 (BASE-USD)

At 21.5 million users, Base has quickly become the consumer’s entry point to DeFi. Transactions cost just one cent. Its dependence on Ethereum and persistent congestion challenges may limit growth.

5. Tron (TRX-USD)

Tron sits at 14.4 million users, powered by cheap stablecoin transfers and integrations with apps like Telegram. Regulatory pressure and centralization fears remain constant headwinds.

6. Bitcoin (BTC-USD)

Even the original cryptocurrency is still climbing, logging 10.8 million active addresses. Institutional ETF inflows are driving fresh momentum. Energy consumption and macro-driven volatility remain the biggest challenges.

7. Aptos (APT-USD)

The Meta spinout chain hit 10 million users, supported by high throughput and its Move programming language. Broader adoption has yet to catch up with its technical promise.

8. Ethereum (ETH-USD)

Ethereum has 9.6 million active users, showing that its developer ecosystem remains dominant. The Pectra upgrade and ETF inflows are helping growth, but fees and scalability are ongoing concerns.

9. Polygon (MATIC-USD)

With 7.2 million users, Polygon continues to attract brands and enterprises. Its Heimdall v2 upgrade improved interoperability, but regulatory scrutiny under Europe’s MiCA framework poses risks.

10. Arbitrum (ARB-USD)

The Layer 2 chain logged 4 million users, fueled by integrations with platforms like Robinhood and fee-cutting upgrades. Its dependence on Ethereum remains its main weakness.

What Is Driving Blockchain Adoption in 2025

Stablecoins are powering liquidity and transaction volumes at record pace. Networks using USDT and USDC are handling billions of transactions and onboarding millions of new users into their ecosystems.

Layer 2 scaling solutions are cutting costs and making decentralized apps affordable for the average user. Base and Arbitrum have reduced fees to a fraction of a cent, which is making high-frequency activity more sustainable.

DeFi protocols and NFT marketplaces continue to pull in millions of new wallets. Platforms like GMX on Arbitrum and Polygon’s NFT marketplaces are turning speculation into sticky usage.

Mainstream integrations are pushing blockchain further into everyday life. Coinbase has funneled millions of retail users onto Base, while global brands like Starbucks (SBUX) are running supply chain tracking on blockchain networks.

In addition, institutional money is legitimizing the space. Bitcoin ETFs have attracted tens of billions of dollars, and corporate treasuries are allocating to networks like Solana and Ethereum, lending credibility to the sector.

Risks that Could Slow the Surge

The industry still faces inflated metrics from bots and inactive wallets that exaggerate real growth. High-speed networks often compromise decentralization, which raises questions about long-term resilience. Regulatory agencies are circling stablecoins and exchange-linked chains, creating potential headwinds. And competition between Layer 1 blockchains and Ethereum’s Layer 2 solutions is intensifying, putting pressure on fees and user retention.

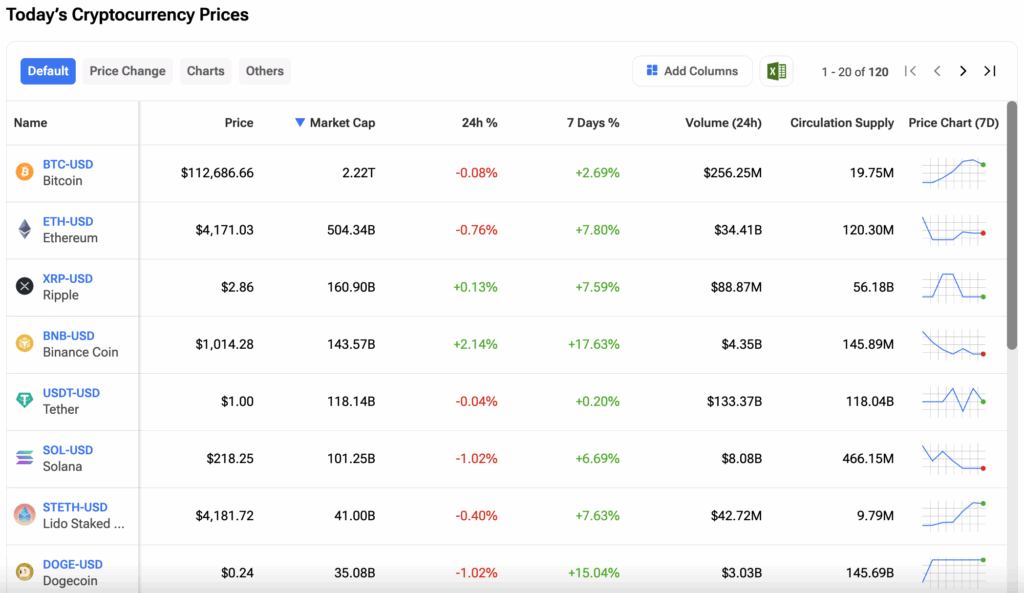

Investors can track the prices of their favorite cryptos on the TipRanks Cryptocurrency Center. Click on the image below to find out more.