The stock market is currently not a friendly place for EV makers. Sentiment is low amidst dog-eat-dog competition and softening demand. Meanwhile, EV stocks are paying the price, one of those being Chinese EV manufacturer XPeng (NYSE:XPEV). To wit, shares are already down by 36% this year.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Deutsche Bank analyst Edison Yu says the weakness is partly down to “fears about the hyper competitive environment.” With that in mind, the near-term outlook does not appear too great, either, although things could brighten up as the year progresses. “In such a context,” says the analyst, “XPeng may largely be in the penalty box until their new products start to ramp, meaning the next quarter or two could remain choppy as the price war rages on while the back half should see a big uplift from new models.”

Yu’s comments come ahead of the company’s Q4 readout, slated for next month. With deliveries having already been announced at a quarterly record 60,158 units (at the low end of the company’s guidance of 59,500-63,500 units), Yu expects focus will mostly turn to the gross margin. The analyst anticipates vehicle GPM (gross profit margin) will be in the 2-3% range, resulting in total gross margin of ~4%. As for the top-line, factoring in a quarter-over-quarter improvement in the ASP (average selling price) on account of a “better mix,” Yu sees revenue reaching 12.9 billion RMB (consensus has 13.4 billion).

That said, for Q1, in what amounts to a big drop from Q4, Yu expects XPeng will guide to between 23,000-28,000 units. “While the new X9 MPV is selling relatively well, other models have clearly lost momentum due to pull-forward into 4Q and competitive pressure,” said the analyst, who also expects the gross margin to “mechanically decline” in Q1, given the “significantly lower volumes.”

Moving forward, given the aggressive discounts offered by other EV makers and legacy ICE OEMs, Yu anticipates a “dogfight” for the existing models. However, in the second half of the year, the product cycle should start to turn in XPeng’s favor. The period will see the launch of a new sedan and of the MONA project, aimed at ride-share fleets in collaboration with Didi. At some point this year, Yu also expects a refreshed P5 sedan.

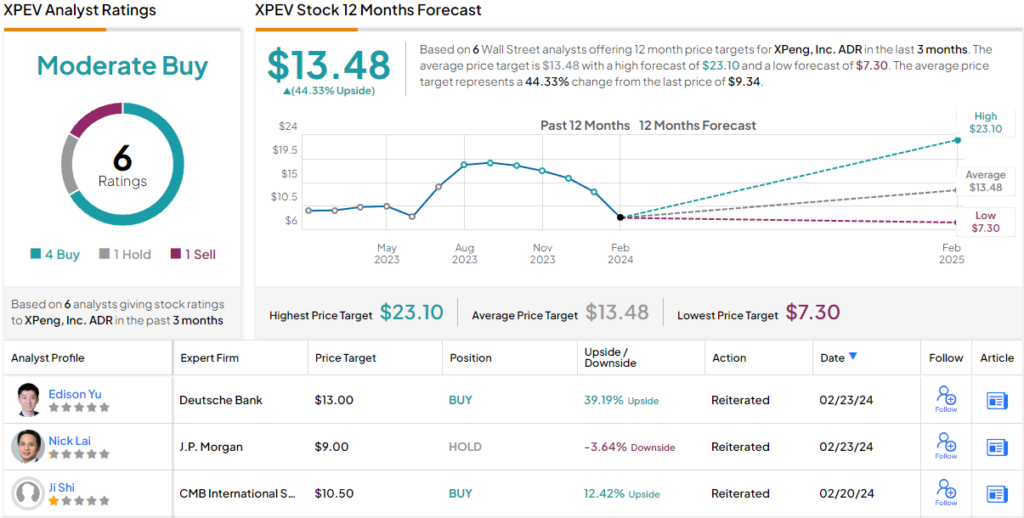

While Yu has lowered some forecasts, and has reduced his price target from $20 to $13, similar to late 2022/early 2023 when sentiment became “too lopsided,” he now thinks the stock has “overshot to the downside,” and therefore keeps a Buy rating on the shares. The new target still makes room for one-year returns of 39%. (To watch Yu’s track record, click here)

Yu’s objective is just below the Street’s average, which currently stands at $13.48, implying the stock will gain 44% over the coming months. Rating wise, based on a mix of 4 Buys, and 1 Hold and Sell, each, the stock claims a Moderate Buy consensus rating. (See XPeng stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.