Vlad Tenev, the CEO of stock trading platform Robinhood (HOOD), said that tokenization—the process of turning real-world assets like stocks, real estate, or bonds into digital tokens that can be traded on a blockchain—is quickly gaining traction and will eventually change the way the global financial system works. Indeed, at a crypto conference in Singapore, he described tokenization as a “freight train” that can’t be stopped and predicted that most major markets will have rules in place to support it within five years. However, he also noted that it could take over a decade for tokenization to be fully established.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

It is worth noting that earlier this year, Robinhood began offering over 200 tokenized U.S. stocks to customers in the European Union. Tenev believes that this digital format will become the standard way for investors outside of the U.S. to buy American stocks. He expects Europe to lead the way in setting clear rules, which could then spread to other regions. Still, he believes that the U.S. may be one of the last countries to fully adopt tokenization because its current financial infrastructure is well-established and harder to change.

Tenev also stated that traditional finance and crypto will eventually merge. In fact, he pointed to stablecoins, digital currencies tied to stable assets like the U.S. dollar, as one of the first real examples of tokenized assets already in use today. As more large financial institutions show interest in this space, Tenev thinks it’s only a matter of time before tokenization becomes a common practice. In his view, cryptocurrency technology is simply more efficient than traditional methods.

Is Robinhood Stock a Good Buy?

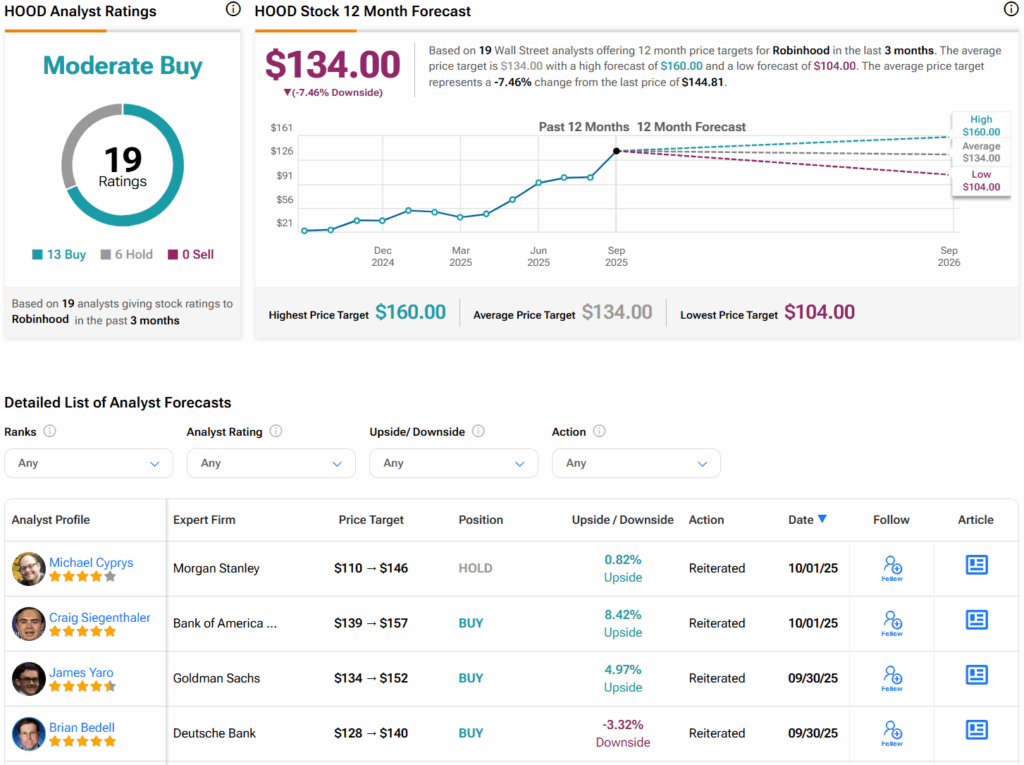

Turning to Wall Street, analysts have a Moderate Buy consensus rating on HOOD stock based on 13 Buys, six Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average HOOD price target of $134 per share implies 7.5% downside risk.