Toast (NYSE:TOST) gained in pre-market trading even as the company announced that it was laying off 10% of its workforce, or around 550 employees. The company expects to incur restructuring-related charges in the range of $45 to $55 million, primarily related to severance costs in the first quarter of FY24.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The digital technology platform for restaurants announced better-than-expected fourth-quarter results.

The company posted Q4 revenue of $1 billion, an increase of 35% year over year, as compared to consensus estimates of $1.02 billion. Toast’s losses narrowed in the fourth quarter to $0.07 per share as compared to a loss of $0.19 per share in the same period last year. Analysts were expecting a loss of $0.11 per share.

Toast’s gross payment Volume (GPV) increased 32% year over year to $33.7 billion. The company defines GPV as the total dollar value processed through its payments platform across “Toast Processing Locations in a given period.”

Looking forward, in the first quarter, the company has projected a gross profit for its adjusted subscription services and financial technology solutions to be in the range of $275 million to $285 million while adjusted EBITDA is likely to be between $15 million to $25 million. In FY24, the company has forecasted gross profit for its subscription services and financial technology solutions in the range of $1.3 billion to $1.32 billion while adjusted EBITDA is likely to be between $200 million and $220 million.

The digital platform’s Board of Directors authorized a stock buyback program of up to $250 million of its Class A common stock. In addition, effective from January 1, 2024, Aman Narang became Toast’s CEO, taking over from Chris Comparato. Both Mr. Comparato and Mr. Narang will remain on the company’s Board of Directors.

What is Toast Stock Prediction?

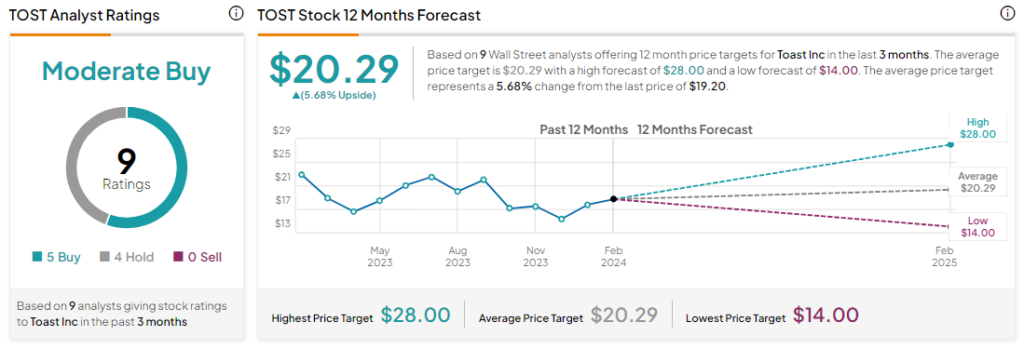

Analysts remain cautiously optimistic about TOST with a Moderate Buy consensus rating based on five Buys and four Holds. Over the past year, TOST has slid by 4.1% and the average TOST price target of $20.29 implies an upside potential of 5.7% at current levels.