Normally, toast is just a vital part of breakfast or a drinking ritual. But Toast (NYSE:TOST), the restaurant technology service company, just got hit like a bus in Wednesday afternoon’s trading. Shares plunged over 13% as the stock’s outlook seemed increasingly dark.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Piper Sandler, by way of analyst Clarke Jeffries, lowered its rating from Overweight to Neutral, citing “…increased uncertainty on the growth outlook…” engendered by its third-quarter earnings call. Jeffries specifically pointed to “…descriptions of modest slowdowns in same-store transaction volume and moderating consumer spend.”

Basically, fewer customers in restaurants mean less call for restaurant technology and, likewise, less call for restaurant technology upgrades. That, in turn, means Toast will have a hard time selling not only to new customers but also to current customers who may have been in line for an upgrade.

Does Toast have a plan to turn this around? Yes, actually, it does. Though based on today’s share price performance, it’s unclear how well investors think it will work. The core of Toast’s plan lies in its product line. During the earnings call, Toast’s COO, Aman Narang, cited the rise of ToastNow, a platform that allows users to manage their restaurants while not actually on premises.

Customers had been clamoring for such tools previously, and Toast’s responsiveness to that demand should insulate it from at least some decline. But in the end, if restaurants start losing cash flow due to a lack of customers, no amount of responsiveness will save Toast completely.

Is Toast Stock a Buy, Sell, or Hold?

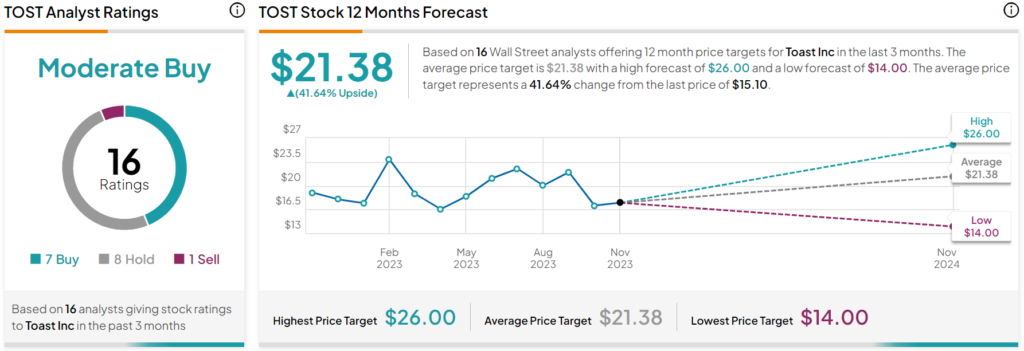

Turning to Wall Street, analysts have a Moderate Buy consensus rating on TOST stock based on seven Buys, eight Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average TOST price target of $21.38 per share implies 41.64% upside potential.