After market close yesterday, TMX Group Limited (TSE:X) reported its Q2-2023 earnings results, which beat both revenue and earnings-per-share (EPS) estimates. As a result, the stock is slightly higher today. TMX Group provides global market operations, analytics, and digital communities to support businesses and investors.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The company reported record revenue of C$306.2 million for the quarter (vs. estimates calling for C$292.3 million), a 7% rise from the C$285.1 million recorded in Q2 2022. Also, adjusted diluted EPS of C$0.38 remained flat year-over-year but beat the consensus forecast of C$0.35.

David Arnold, CFO of TMX Group, pointed out that the higher overall revenue was largely led by significant increases in its Trayport and TMX Datalinx operations, although this was somewhat offset by lower capital raising and equities trading activities.

In light of the financial performance and following the recent five-for-one stock split, the company’s board decided to increase the quarterly dividend by 3%, taking it to C$0.18 per share.

What is the Price Target for TMX Group Stock?

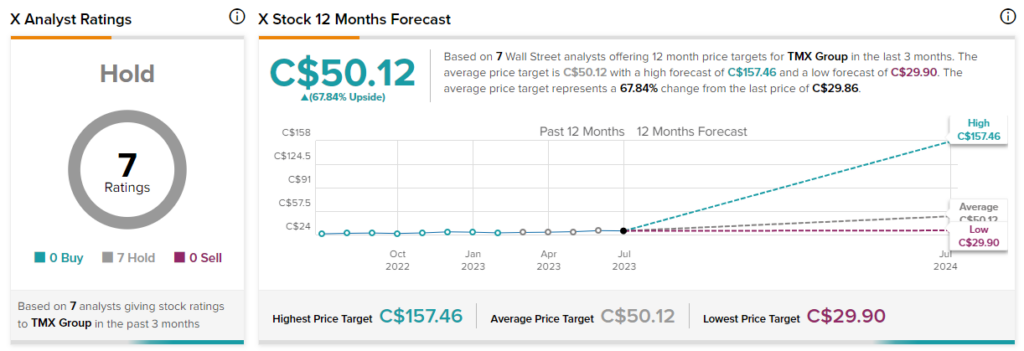

According to analysts, TMX Group stock has a Hold consensus rating based on seven unanimous Hold ratings assigned in the past three months. However, the average TMX Group stock price target of C$50.12 implies a whopping 67.8% upside potential.