Tilray (TLRY) stock surged higher on Thursday after the cannabis company released its Fiscal Q1 2026 earnings report. That report began with flat adjusted diluted earnings per share, which was better than the -3 cents that Wall Street expected. It was also an improvement over the -1 cent per share reported in Fiscal Q1 2025.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Tilray reported revenue of $209.5 million during the quarter, which surpassed analysts’ estimate of $204.55 million. It also represented a 5% improvement year-over-year from $200 million. Investors will note that this is a record Q1 for the company. Much of Tilray’s revenue growth was attributed to its cannabis sector, which saw a 5% revenue growth from the same time last year.

Tilray stock was up 12.79% in pre-market trading on Thursday, following a slight gain yesterday. The stock has increased 29.32% year-to-date and 8.18% over the past 12 months.

Tilray Guidance

Tilray didn’t provide a formal guidance update in its most recent earnings report. Even so, company leaders did discuss its future. Irwin Simon, Tilray’s Chairman and CEO, said, “Looking forward, I am confident in Tilray’s ability to seize the transformative opportunities ahead, especially as the U.S. explores cannabis rescheduling and the European cannabis landscape continues to evolve.”

Simon also highlighted Tilray’s expertise in medical and adult-use cannabis, as well as its partnerships with patients, healthcare professionals, and policymakers. He said these set the company apart from others in the cannabis industry. Finally, the CEO stated that the company’s performance and position “reinforce my unwavering belief in Tilray’s trajectory and our ability to deliver long-term value to our investors.”

Is Tilray Stock a Buy, Sell, or Hold?

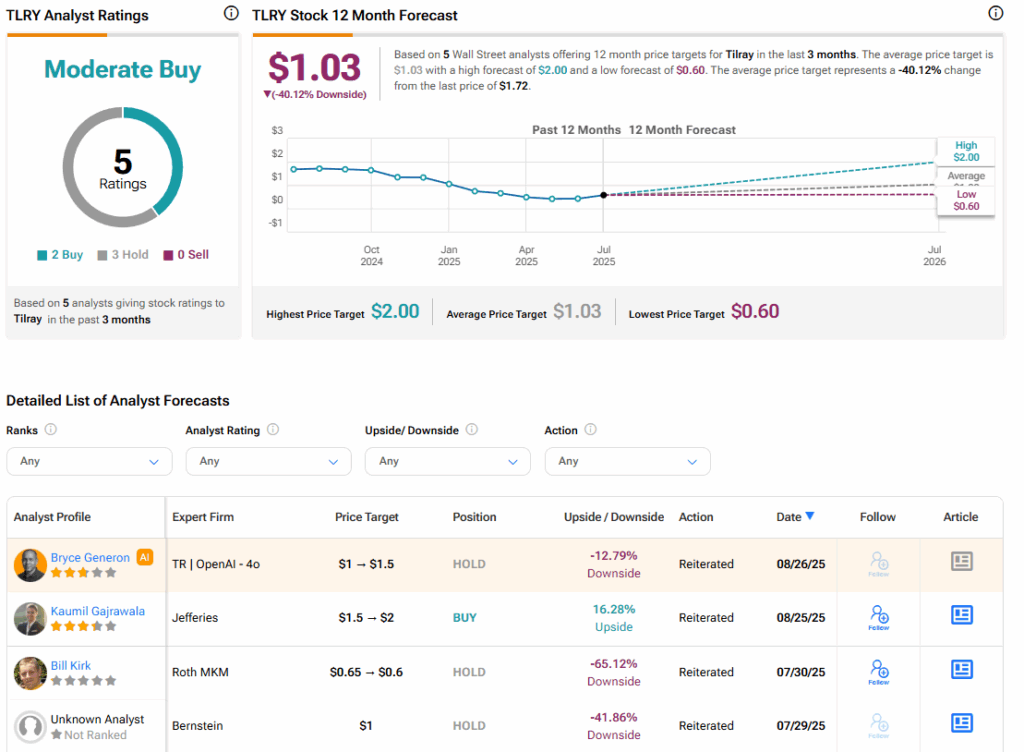

Turning to Wall Street, the analysts’ consensus rating for Tilray is Moderate Buy, based on two Buy and three Hold ratings over the past three months. With that comes an average TLRY stock price target of $1.03, representing a potential 40.12% downside for the shares. These ratings and price targets will likely change as analysts update their coverage after today’s earnings report.