There are numerous indices worldwide, each comprising different sets of companies to provide a snapshot of market trends. TipRanks is doing something similar with its TipRanks 50 Index (TRMX) —a rules-based snapshot of where analyst conviction and price strength intersect. The index comprises 50 U.S.-listed names with the strongest positive momentum, selected from the 100 most highly recommended companies on the TipRanks platform. Think of it as a curated shortlist that filters for both broad Wall Street endorsement and clear confirmation from the tape.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

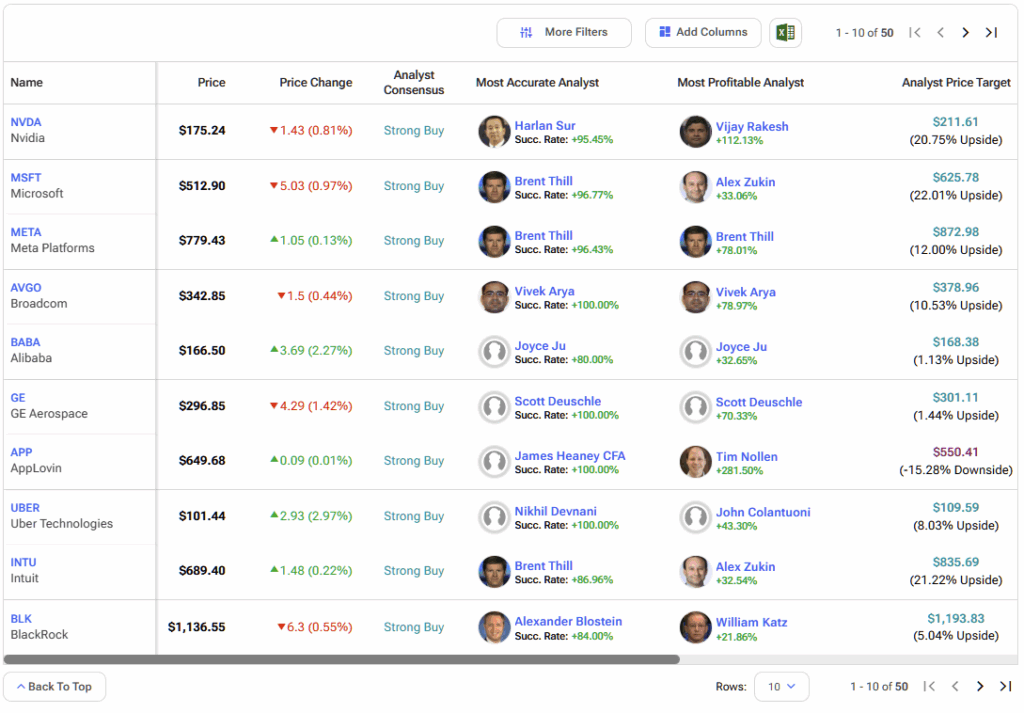

Based on TipRanks data, here are the TRMX’s ten biggest firms by market capitalization.

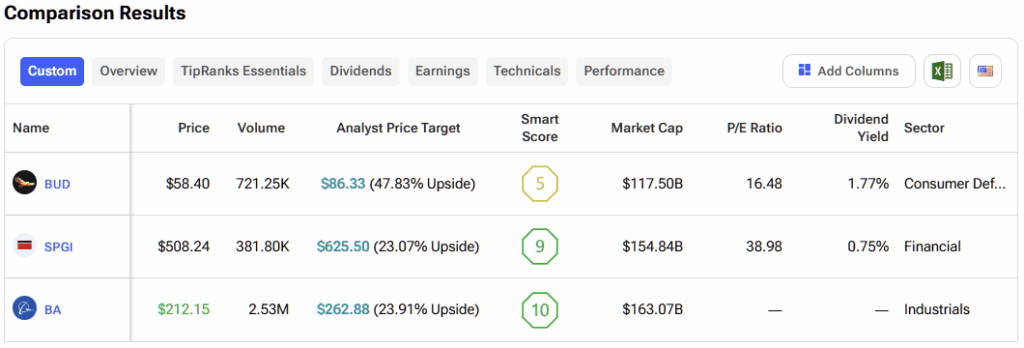

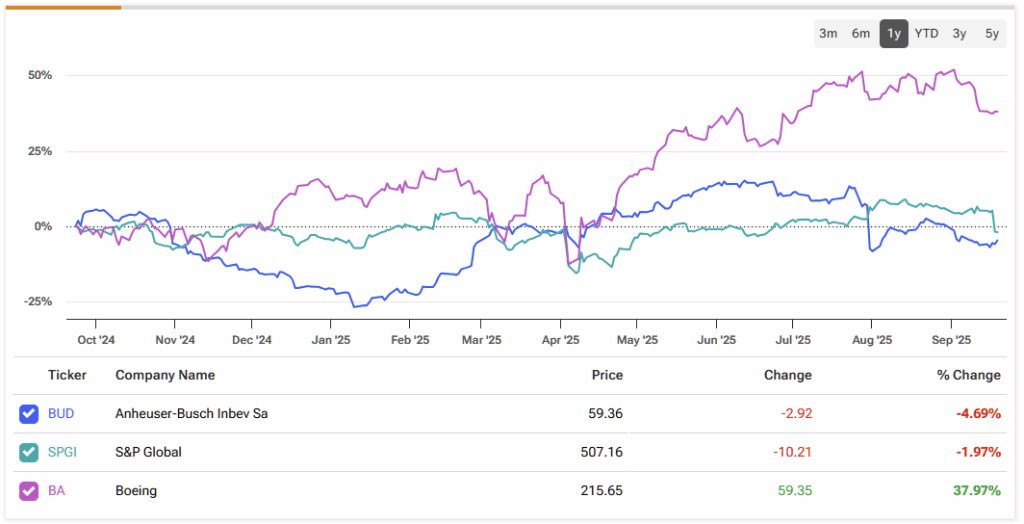

From that group, I’ve zeroed in on three with compelling near-term return potential: Anheuser-Busch InBev (BUD), S&P Global (SPGI), and Boeing (BA). Each is driven by very different catalysts, but all share the tailwind of favorable sentiment.

Anheuser-Busch InBev (NYSE:BUD)

AB InBev’s latest report reads like a case study in “make the mix do the work.” Management leveraged premiumization and revenue management to increase revenue per hectoliter by 4.9% and boost EBITDA by 6.5%, despite pockets such as Brazil and China remaining soft.

In the U.S., momentum clustered around Michelob Ultra and Busch Light, two brands that, according to the company, were among the year’s top innovation winners, helping North America grow EBITDA amid a sluggish category. That blend (less volume heroics, more brand and price discipline) is precisely the kind of execution that has sustained the stock high among momentum screens.

Zoom in, and the micro-catalysts are evident, as “Michelob ULTRA Zero” and “Busch Light Apple” drove shelf excitement. U.S. revenue grew with modest volume improvement compared to the industry, while global premium labels continued to take market share.

The strategy is deliberately straightforward, as it revolves around funding brands, taking prices where you’ve earned them, and widening the margin a notch at a time, but it’s working. The market did notice the challenges (notably LatAm and China volume), but the margin math and cash generation stayed intact, keeping the stock in the Index’s momentum mix.

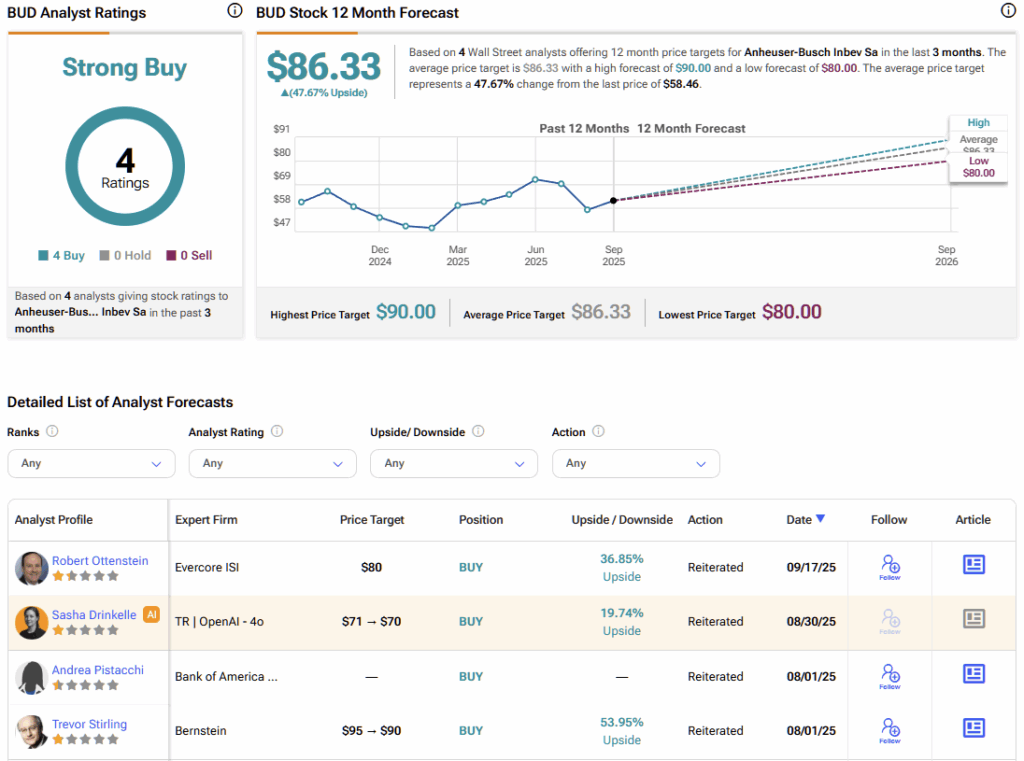

Is BUD Stock a Buy, Hold, or Sell?

Analyst sentiment remains pretty bullish on BUD. The stock carries a Strong Buy consensus rating, based on four unanimous Buy ratings assigned over the past three months. No analyst rates the stock a Hold or a Sell. Furthermore, BUD’s average stock price target of $86.33 implies ~47% upside over the next twelve months.

S&P Global (NYSE:SPGI)

SPGI has been quietly compounding returns for decades, and its latest results once again reminded us of its unique moat and restless operating excellence. The company grew revenue 6% with adjusted EPS up 10%, nudged guidance higher, and remarked it would execute up to $1.3 billion of accelerated buybacks.

Under the hood, subscription revenue rose ~7%, with Ratings benefiting from healthier pipelines and the indices/derivatives engine continuing to perform well. When management discusses capital return and steady margin expansion (70 bps in the quarter), momentum screens take note.

The strategic catalyst worth noting these days is the planned breakup of the Mobility unit. This portfolio move refocuses SPGI on its core data, benchmarks, and workflow franchises, while letting Mobility stand on its own in terms of capital needs. It’s the sort of simplification investors reward, as we are now getting a cleaner story, more explicit capital allocation, and fewer moving parts.

Simultaneously, it is accompanied by evidence of strong demand for analytics (Q2 slides point to robust equity inflows and double-digit ETD growth), which is why the stock’s sentiment has stayed buoyant inside the TipRanks 50.

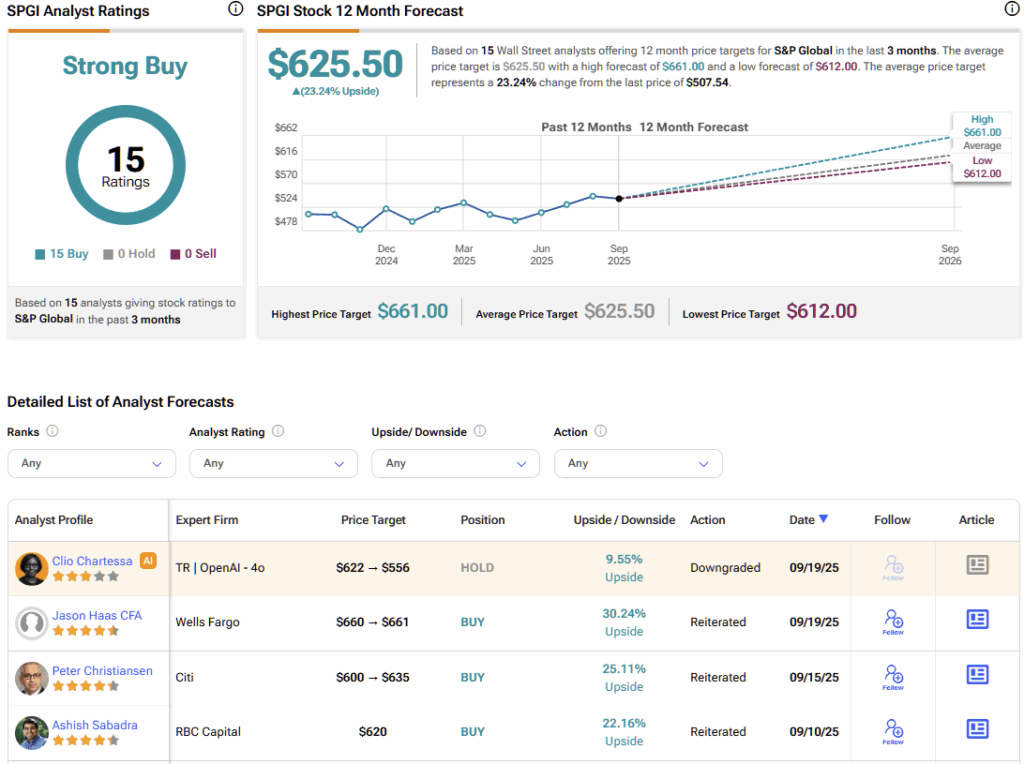

Is SPGI Stock a Good Buy?

On Wall Street, S&P Global also features a Strong Buy consensus rating based on 15 unanimous Buy ratings. Again, no analyst rates the stock as a Hold or a Sell. SPGI’s average stock forecast of $625.50 implies over 23% upside potential over the next 12 months.

Boeing (NYSE:BA)

Boeing’s momentum is the most debated, and that’s precisely why the share price has been responsive to operational proof points. The last quarter saw 150 commercial deliveries, with revenue reaching $22.7 billion, 737 output stabilizing at ~38/month, and a backlog swelling to ~$619 billion (5,900+ jets). The August data then added a psychological win, as year-to-date deliveries had already eclipsed 2024’s full-year count, with the company posting its strongest August since 2018 —a tangible step toward normalizing a bruised franchise.

Management says the goal is to maintain the rate at 38 and request approval from the FAA to increase to 42/month later this year, focusing on measured progress rather than bravado. Regardless, the market seems to care less about quarter-to-quarter P&L and more about some MAX stabilization, 787 at seven/month, and widebody momentum that can translate backlog into cash. Under CEO Kelly Ortberg, the messaging has been “stabilize first, then step up,” and the delivery trend line has started to validate that approach.

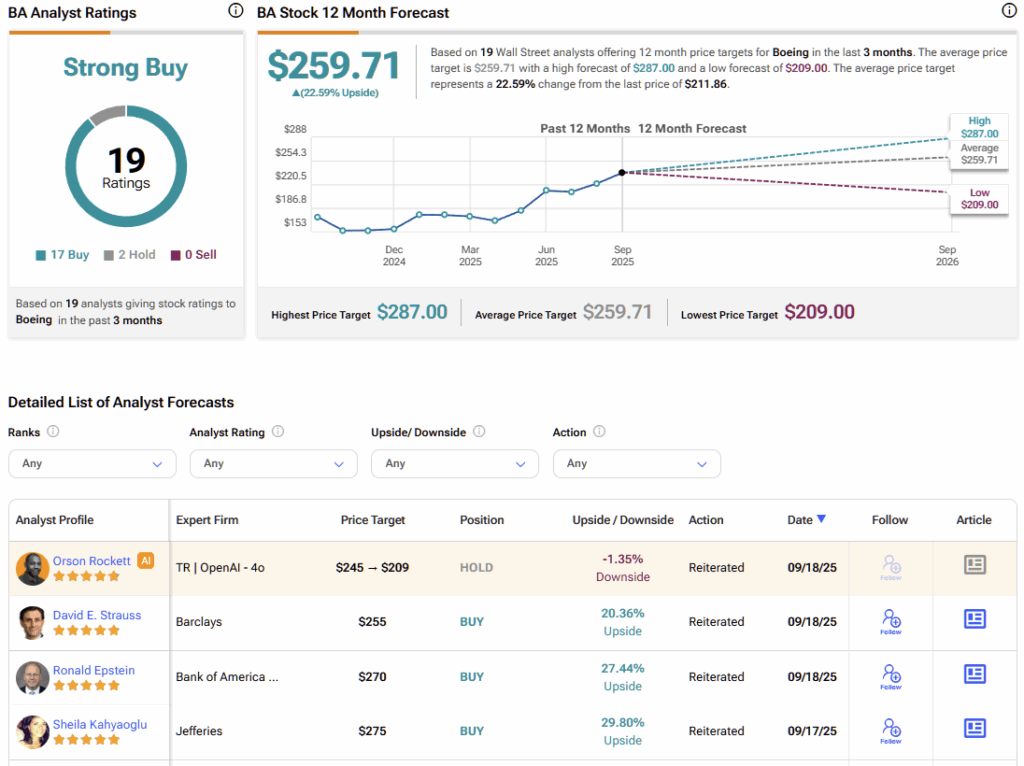

Is Boeing Stock a Buy, Hold, or Sell?

Boeing is now covered by 19 Wall Street analysts, and sentiment is exceptionally bullish. The stock carries a Strong Buy consensus driven by 17 Buy and two Hold ratings. No analyst rates the stock a Sell. In the meantime, Boeing’s average stock price target of $259.71 indicates ~22.5% upside potential over the next twelve months.

The Common Thread Between BUD, SPGI, and BA

Different sectors, same momentum logic. AB InBev shows that premium mix and brand investment can outpace volume noise. S&P Global is sharpening its portfolio while benefiting from both cyclical issuance tailwinds and the perpetual demand for data. Boeing, meanwhile, is stringing together enough operational wins to persuade investors that a production-led recovery is underway—legal clouds and all. None of this demands heroics, only steady execution reflected in margins, guidance, and deliveries. That’s why all three appear in the TipRanks 50: they combine firm analyst conviction with price action that confirms the story is playing out in real time.