The solar sector is in turmoil, and Enphase Energy (ENPH) is bearing the brunt of it.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

Three major analysts from Barclays (BCS), BMO Capital (BMO), and BNP Paribas Exane have slashed their ratings on Enphase stock, warning that a looming policy shift could hurt demand for the company’s products. ENPH stock was down about 6% in the pre-market trading session, reflecting investor concerns about the company’s future.

Policy Change in Question

Before looking at the analysts’ view, let’s understand the key policy change due to which several analysts have downgraded the stock.

The Section 25D Residential Clean Energy Credit is a 30% tax credit that allows homeowners to reduce the cost of installing solar panels and battery storage. If repealed, homeowners who pay cash or take loans for solar systems would lose this benefit starting in 2026.

This change would shift the solar market toward third-party ownership, where companies like Sunrun (RUN) and Sunnova Energy (NOVA) install and own the systems instead of individual homeowners.

Analysts Warn Policy Shift Could Hurt ENPH

It must be noted that Barclays analyst Christine Cho, CFA, double-downgraded ENPH stock to Sell from Buy, citing the potential repeal of Section 25D. Further, Cho cut UNH stock’s price target to $40 from $51.

With Enphase heavily reliant on direct solar sales, the analyst warns that a 90% shift to third-party solar ownership next year could impact its market share.

At the same time, Ameet Thakkar, analyst at BMO Capital, downgraded Enphase stock to Sell from Hold and slashed the price target to $39 from $46. The analyst noted that if the new tax plan removes the Section 25D credit by the end of 2025, it could hurt Enphase if fewer homeowners choose cash or loan payments for solar systems.

BNP Paribas Exane analyst Moses Sutton echoed similar concerns, lowering Enphase to Sell from Hold, with a $40 price target.

Is Enphase a Buy or Sell?

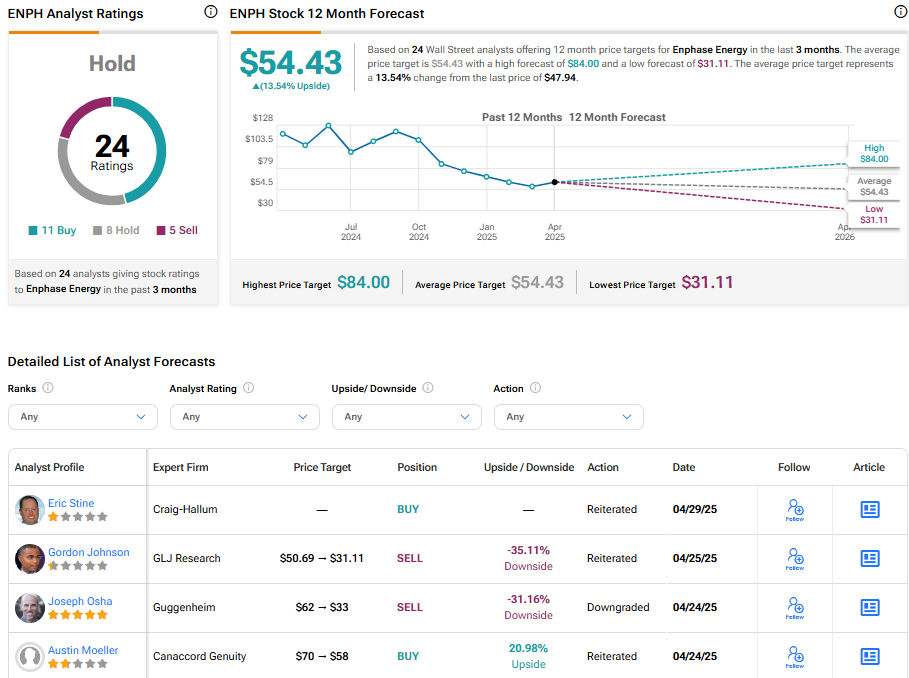

Turning to Wall Street, ENPH stock has a Hold consensus rating based on 11 Buys, eight Holds, and five Sells assigned in the last three months. At $54.43, the average Enphase stock price target implies a 13.54% upside potential.