Taiwan Semiconductor Manufacturing (NYSE:TSM) is no doubt paying extra close attention to the messages coming from Washington these days. President Trump’s on-again, off-again tariffs on semiconductors have thrown markets for a loop and created plenty of uncertainty for the world’s largest chip foundry.

Yet, despite the political noise, TSM is powering forward. In Q1 2025, the company delivered solid results, surpassing Wall Street expectations on both fronts; revenue came in at $25.78 billion, beating estimates by ~$59 million, while EPS landed at $2.12, topping projections by $0.06.

And the momentum isn’t slowing. TSM’s guidance for Q2 points to another impressive stretch, with projected revenues between $28.4 and $29.2 billion, marking double-digit growth from the previous quarter.

Investor Bram De Haas came away from TSM’s earnings call feeling much better about the company’s prospects.

“TSM’s confidence in doubling AI revenue this year despite the tariff chaos is a resounding vote of confidence in the strength of market demand here,” says the investor.

De Haas notes that the company shared that the evolving international landscape has not let to “any change in customer behavior” due to tariff policies. While acknowledging that this does not mean that discussions are taking place behind the scenes, the investor is latching onto this positive signal.

Moreover, De Haas cites the growing demand for AI, which is expected to increase by a CAGR in the mid-40s% for the next five years. TSM is putting its money where its mouth is, explains the investor, refusing to budge from its previously stated capex guidance on the earnings call.

“This suggests management really believes in continued long-term growth, despite near-term uncertainties and potential semiconductor tariffs,” adds De Haas.

Pleasantly surprised by the company’s faith in its continued growth, the investor is therefore ready to jump onboard.

“The key takeaway, to me, remains the immense strength of the AI trend,” concludes De Haas. “Even the incredible chaos introduced by the White House’s trade policy, doesn’t seem able to derail it.”

With that, De Haas is placing his bet, assigning a Buy rating on TSM shares. (To watch Bram De Haas’ track record, click here)

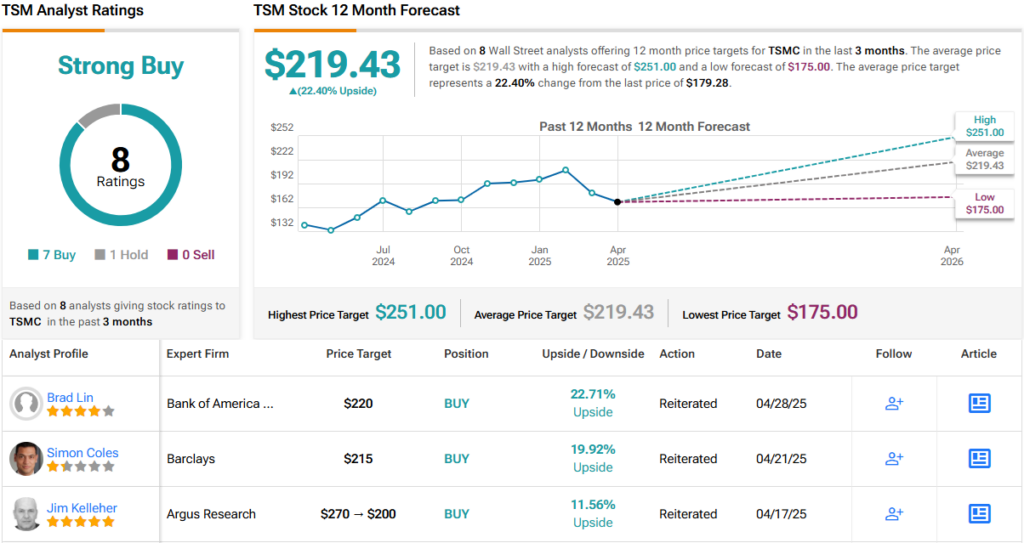

Wall Street is also ready to up the ante on TSM. With 7 Buy and 1 Hold recommendations, TSMC enjoys a Strong Buy consensus rating. Its 12-month average price target of $219.43 implies an upside of ~22% from current levels. (See TSMC stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.