Nvidia (NASDAQ:NVDA) has faced a challenging landscape in 2025, navigating a mix of uncertainties. Export restrictions have complicated its business in China, and broader concerns about the pace of capex investments by hyperscalers have added a layer of caution to the growth narrative that once seemed unstoppable.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Still, not everyone is hitting the panic button. Despite a nearly 15% year-to-date slide, investor Bohdan Kucheriavyi argues that the risks are overblown – and there are blue skies aplenty for Nvidia up ahead.

“I’m still confident in the company’s ability to create additional shareholder value over the following years,” asserts the 5-star investor.

That’s not to say that Kucheriavyi is dismissive of the very real risks of decreasing capex spending by the hyperscalers – far from it. The investor notes the recent reports that Microsoft and Amazon have been walking away from data center leases, a move that could signal cooling demand for Nvidia’s chips. But in the same breath, he highlights evidence pointing in the opposite direction: AI spending among hyperscalers is still on track to hit $300 billion this year. Strong results from TSMC and even AI momentum at beleaguered Intel hint that the appetite for AI infrastructure isn’t fading.

Meanwhile, Nvidia is actively adapting to geopolitical headwinds. The company is shifting key production of its next-gen Blackwell chips to TSMC’s Arizona facility. By localizing production, Nvidia aims to mitigate risks associated with geopolitical tensions, such as potential tariffs and export restrictions, and to better meet the growing demand for AI chips and supercomputers.

“This should help the company be less exposed to any geopolitical and tariff-related risks, which is a major upside in the current environment,” adds Kucheriavyi.

The investor also acknowledges the added difficulties the company will face in the Chinese market in the years ahead, as trade restrictions will give domestic competitors such as Huawei a pronounced leg up over the American firm.

Even so, a 10% sales hit tied to China-related disruptions hasn’t shaken his conviction. In his view, Nvidia remains undervalued – and the long-term upside is still very much intact.

“Nvidia’s upside remains significant, even if we take into account the loss of China-related revenues this year,” concludes Kucheriavyi, who rates NVDA stock a Buy. (To watch Kucheriavyi’s track record, click here)

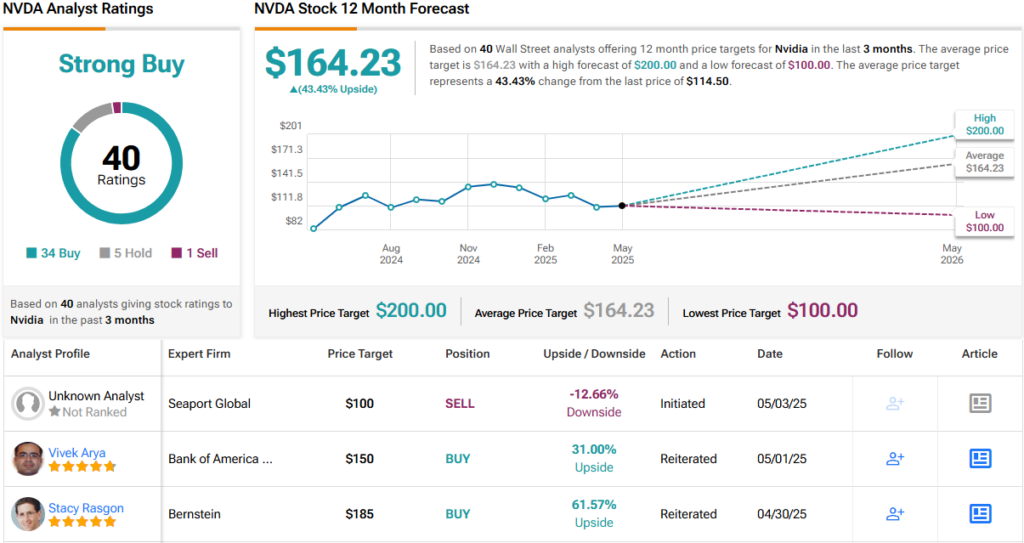

Wall Street needs no additional convincing. With 34 Buys, 5 Holds and a single Sell, NVDA enjoys a Strong Buy consensus rating. Its 12-month average price target of $164.23 implies a ~43% upside for the year ahead. (See NVDA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.