Alibaba (BABA) climbed about 3%, topping the list of biggest market cap gainers on Monday. The stock is now up 39% year-to-date and has surged over 55% over the past 12 months. The Chinese e-commerce and cloud giant is gaining momentum as it leans further into AI and cloud technology. Recently, Alibaba reaffirmed plans to invest 380 billion yuan (about $52.4 billion) over three years to boost its computing power and expand its AI foundation. Adding to investor confidence, Ray Dalio’s Bridgewater Associates has raised its stake in Alibaba—another signal of growing belief in the stock. With all these factors in play, Wall Street analysts see nearly 43% upside from current levels.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Alibaba’s Q4 Earnings Show AI Strength

Alibaba recently reported its Q4 results for Fiscal 2025, which came in a bit below what analysts had hoped for. Still, there were signs of solid growth, especially in cloud and AI.

Cloud revenue jumped 18% year-over-year to RMB30.1 billion, supported by robust growth in AI-related product sales. While the company didn’t specify its AI revenue, it said that AI-related product revenue saw triple-digit growth for the seventh consecutive quarter.

Meanwhile, sales from the Taobao and Tmall Group (TTG) rose 9% in Q4. Also, revenue from customer management services—which includes ads and other tools for sellers—rose 12%, showing stronger merchant demand.

Top Analyst Remains Positive on Alibaba’s Future

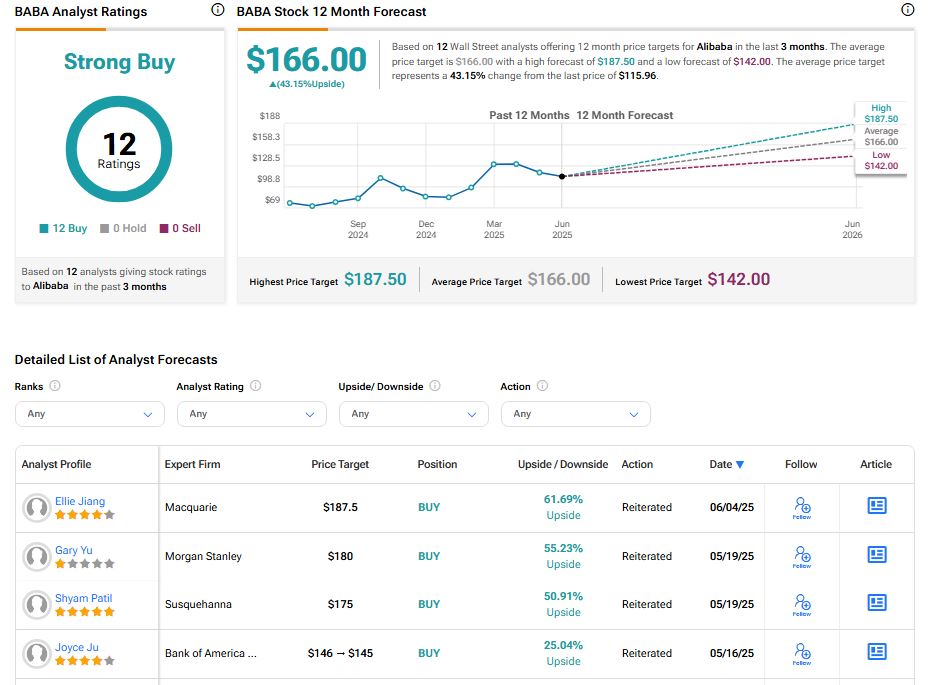

Last week, Macquarie analyst Ellie Jiang kept her Outperform rating and $187.50 price target on Alibaba stock. After a recent visit to the company’s office, the top analyst expressed strong confidence in Alibaba’s future growth prospects.

Jiang pointed out that while the company is lowering prices to stay competitive in the instant delivery space, this short-term move is part of a broader plan to drive growth. She expects higher ad sales and better merchant services to support profits going forward.

On the tech front, Jiang highlighted rising demand for Alibaba’s AI tools, especially from large firms. This, she believes, will help lift cloud revenue in the coming quarters. She also noted that Alibaba’s three-year AI investment plan remains on track, which reflects the company’s steady focus on long-term growth in cloud and AI.

Is Alibaba Stock a Good Buy Right Now?

Analysts remain highly bullish about Alibaba’s stock trajectory. With 12 unanimous Buy ratings, BABA stock commands a Strong Buy consensus rating on TipRanks. Also, the average Alibaba price target of $166 implies 43% upside potential from current levels.