Strategy (MSTR) has been one of the market’s biggest Bitcoin proxy plays, with the stock up about 37% over the past year. In a new research report, Citi analyst Peter Christiansen initiated coverage on Strategy with a Buy rating and a $485 price target, implying roughly 60% upside from current levels. The analyst said Strategy has effectively become a direct play on Bitcoin’s price movement, given that the company now holds nearly 3% of all Bitcoin in circulation.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Christiansen believes the stock will continue to move in line with Bitcoin, as rising crypto prices boost Strategy’s market value and help it raise more funds to buy additional Bitcoin.

A High-Risk, High-Reward Bet

The analyst noted that under Executive Chairman Michael Saylor, the company has evolved into what Citi calls a “Digital Asset Treasury.” Strategy uses debt and preferred shares to grow its Bitcoin holdings while trying to keep shareholder dilution under control. Citi said this approach gives investors amplified exposure to Bitcoin’s upside, but it also increases risk during market pullbacks.

Citi expects the stock’s premium to net asset value (NAV) to stay in the 25–35% range, based on a projected 9.6% Bitcoin yield in 2026. Christiansen said this premium reflects investor confidence in the company’s ability to grow its Bitcoin per share.

While Citi warned that high leverage and dilution risks remain, the analyst also said the company’s funding plan is well managed. Christiansen views Strategy as a high-risk, high-reward play for investors seeking strong exposure to Bitcoin’s next big move.

To conclude, Citi expects Bitcoin to climb to about $181,000 over the next year, which supports its positive view on Strategy’s stock.

Is MSTR Stock a Buy Right Now?

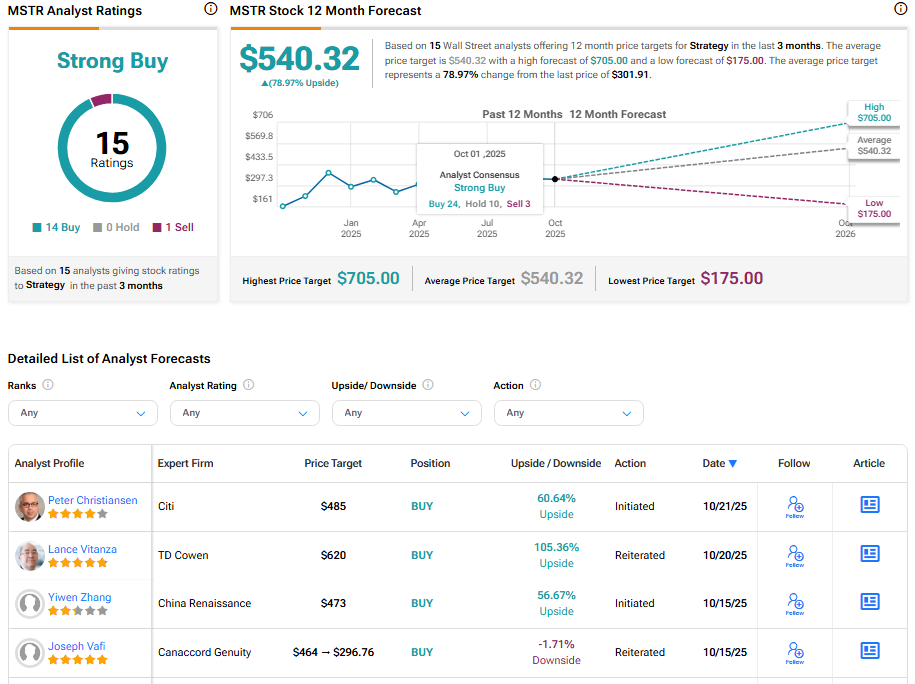

According to TipRanks, MSTR stock has a consensus Strong Buy rating among 15 Wall Street analysts. That rating is based on 14 Buys and one Sell assigned in the past three months. The average MSTR price target of $540.32 implies a 78.97% upside from current levels.