The market has seemingly lost interest in Chinese EV companies and that has led to a decline in the value of their stocks. Nio (NYSE:NIO) is amongst the names that have been hit hard, shedding 42% since 2024 entered the frame.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

But as is often the case, the best opportunities in the market often present themselves when a stock is at its lowest ebb. Looking at Nio’s current situation, investor Stone Fox Capital certainly strikes a confident tone regarding the car maker’s prospects.

“My investment thesis remains ultra-bullish on the large opportunity ahead for the Chinese EV company, with a high-volume brand utilizing advanced technology from the NIO brand,” Stone Fox Capital said.

That “high-volume brand” is the Onvo brand, which represents Nio’s foray into the mass market, for which Nio unveiled its inaugural product last week. The company aims to deliver premium EV experiences to the mainstream auto market with the Onvo L60, a smart electric mid-size SUV priced from RMB 219,900 ($30,500). Deliveries will kick off in Q3 with the vehicle expected to go up against Tesla’s Model Y, albeit at a lower selling price.

Nio’s focus on the premium end of the market has resulted in a lack of consistent sales, the volatile monthly numbers making the stock a “difficult investment.” To meaningfully cut operating losses, the Onvo brand’s sales will need to surpass 20,000 units a month, something Nio’s premium brand has failed to do. Stone Fox Capital thinks the Onvo brand could “easily help the company double sales” and thereby bring it much closer to $4+ billion per quarter, a figure that will help “reduce the operating losses to tolerable levels.”

“Of course,” Stone Fox goes on to say, “the question with NIO at this point is whether operating 2 different brands can help cut the ongoing massive losses, or if the additional sales are only met with higher operating costs.”

Stone Fox obviously comes down on the optimistic side and recommends investors make the most of the current set of circumstances. “The stock valuation has fallen to only $10 billion, while the sales opportunity in the mass market vehicle space is excellent,” the investor summed up. “NIO is now valued based on a company with limited growth ahead, while the business could easily soar from current levels.”

The ongoing Chinese EV sector weakness represents an “opportunity to own NIO,” says Stone Fox, and as such, the investor rates the shares a Strong Buy. (To watch Stone Fox Capital’s track record, click here)

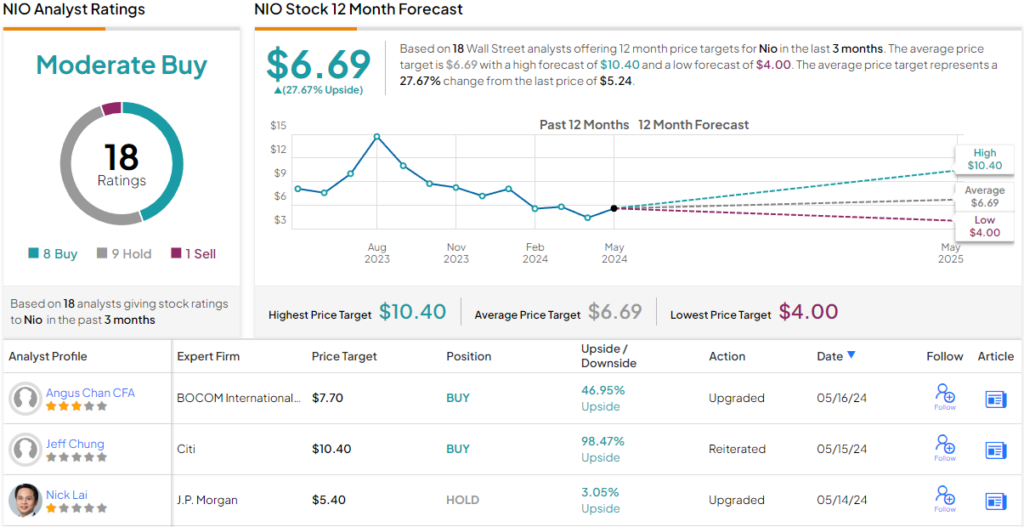

Wall Street is not quite as bullish. Nevertheless, the stock still claims a Moderate Buy consensus rating, based on 8 Buys, 9 Holds and 1 Sell. Going by the $6.69 average target, a year from now, shares will be changing hands for a ~28% premium. (See Nio stock forecast)

To find good ideas for EV stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.