The last three months have been intense for Tilray Brands (TLRY) shareholders. After the stock was in free fall until the end of June, positive signals around U.S. cannabis regulation—most notably President Trump signaling support for reclassifying cannabis as a substance with lower abuse potential—were enough to reignite bullish momentum. Investors quickly began anticipating favorable tailwinds in a sector that has faced more challenges than treats.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

This is particularly true for Tilray, even though the company is more of a conglomerate of brands and its core cannabis operations are in Canada, where cannabis is already legal. In the U.S., Tilray’s focus is primarily on its beer and distillery business. Given that these regulatory impacts are still uncertain and not necessarily tied to short- or medium-term improvements in fundamentals, the recent spike in Tilray’s valuation seems overly abrupt, in my view—especially with Fiscal Q1 earnings due in less than two weeks, which are likely to show continued struggles and dilution.

In any case, I see the current bullish momentum as unlikely to be sustainable and maintain a Sell rating on TLRY stock.

The Long Game of Losses and Dilution

First, it’s essential to separate Tilray stock’s long-term and short-term performance. Examining TLRY’s chart over the past five years, we can see that since February 2021, when the stock reached approximately $64 per share, it has lost 94% of its value, effectively becoming a struggling penny stock.

Of course, this devaluation wasn’t due to a single bad quarter or bad luck. It’s the result of several headwinds: an overly aggressive acquisition strategy (Tilray is now a conglomerate of multiple companies) that came at the cost of heavy shareholder dilution, a cannabis sector still constrained by delayed regulatory tailwinds, and—most importantly—the inability to turn inconsistent revenue growth into profits or strong margins.

Several acquisitions, including Aphria, Manitoba Harvest, SweetWater, HEXO, and others, came at a high price. When the Canadian and U.S. cannabis markets failed to deliver the projected growth in 2021 and 2022, Tilray had to revalue these assets. These impairment tests resulted in billions of dollars in accounting write-offs, which largely explain the persistent losses and the company’s reliance on funding—not through debt, but through equity issuance.

To put it in perspective, over the past five years, Tilray has increased its number of outstanding shares at a CAGR of 30.7%, all while posting sizable net losses and burning cash (with the single exception of 2023).

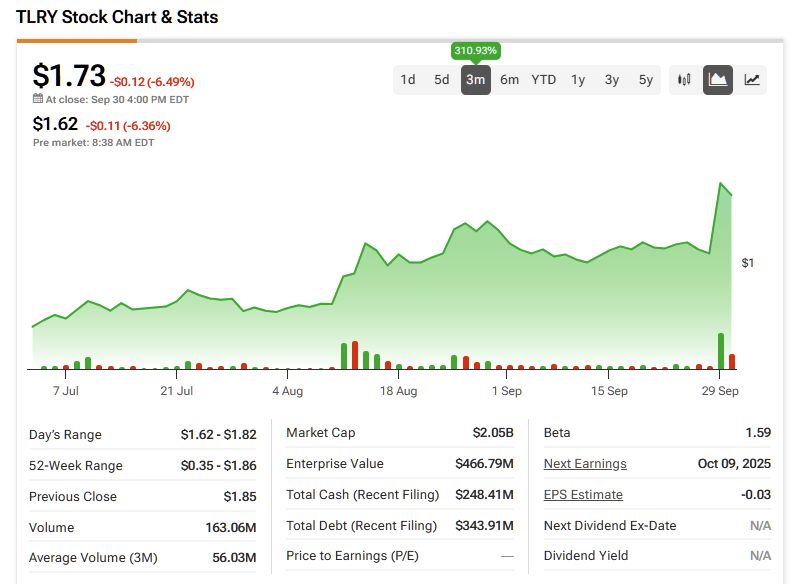

Quick Look at the Year’s Volatility

Zooming in on TLRY’s performance chart for 2025, the year can be split into two distinct phases. The first, from January through the end of June, saw the company lose up to 75% of its market value. The second phase, from the end of June to early October, was a complete reversal, with the stock surging over 372% in just three months.

During the first phase, nothing extraordinary happened with Tilray itself. Financial performance remained weak, as the company missed both top- and bottom-line targets for three consecutive quarters (November, February, and May). At the same time, equity dilution increased 26.2%, 28.8%, and 30.3% year-over-year, respectively, while the company continued to burn cash.

Guidance was also slashed. Analysts reduced their projections for Fiscal 2026 by 8% over the last six months, and 10% and 16% for Fiscal 2027 and 2028, respectively, implying a revenue CAGR of just 4.7% during this period. Under these assumptions, the company is not expected to turn a profit until Fiscal 2029.

The second phase of 2025, when shares jumped triple digits and largely offset the losses from the first seven months, was driven almost entirely by hype and momentum tied to regulatory and political developments in the cannabis sector. The key catalyst was the expectation that Donald Trump would move forward with reclassifying cannabis to Schedule III.

For reference, Schedule III does not legalize marijuana outright, but it removes cannabis from the most restrictive classification and acknowledges it as a substance with accepted medical use. In theory, this provides tax relief—specifically, removing the 280E tax penalty and allowing U.S. cannabis operators to deduct regular business expenses.

While this regulatory change does not directly benefit Tilray—since its core cannabis operations are in Canada, and its U.S. business is primarily in beverage alcohol—it could create M&A tailwinds. More broadly, TLRY’s sensitivity to cannabis-sector news helps explain much of the recent volatility, which reflects correlation with regulatory developments rather than a fundamental improvement in the company’s operations.

What Comes After the Rally

Importantly for current shareholders and potential investors alike, Tilray is set to report its Fiscal Q1 2026 earnings on October 9, now trading comfortably above the $1 per share minimum bid price and back in compliance with Nasdaq, avoiding delisting and a potential reverse stock split.

While momentum has been bullish for Tilray in recent months, the same cannot be said for its underlying business fundamentals. Analysts project a loss of $0.03 per share for Q1, with revenues of $205.75 million—representing modest growth of 2.8%, roughly 10% below estimates for the same quarter six months ago.

Any hope for a stronger quarter stems mainly from management’s expectation of a recovery in the international cannabis market, as export barriers in Portugal and Spain are resolved, coupled with a slight stabilization in the Canadian market, where price pressure is easing and industry consolidation is underway. Medium-term tax relief or excise tax changes could also provide a tailwind.

In any case, this quarter is unlikely to be marked by massive non-cash impairments—like the ~$2 billion recorded in Q4 tied to market cap declines and revised asset valuations.

Given the complexity of valuing a pre-profit company that’s burning cash and massively diluting shareholders, I find a simple and practical metric to gauge TLRY’s pricing to be its book value, which can serve as a rough “floor” proxy. Currently, TLRY trades at 1.3x P/B, significantly above its average of 0.4x this year and over the last five years, despite no material improvement in fundamentals—rather than the bullish momentum fueled by the cannabis segment, which appears overvalued in the current context.

Is TLRY a Buy, Hold, or Sell?

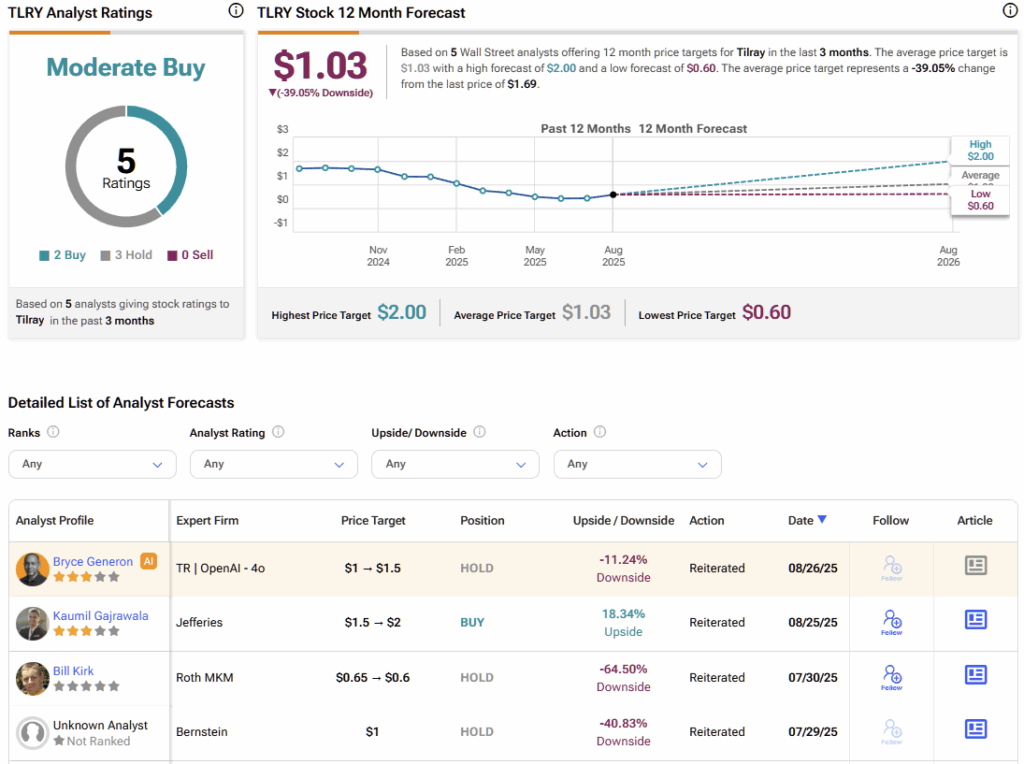

The consensus among five Wall Street analysts on Tilray is moderately bullish, with two issuing Buy ratings and three remaining neutral with Holds. TRLY’s average price target is only $1.03, implying an eye-watering potential downside of 40% from the current share price.

When Optimism Outruns Reality for Tilray

While positive news around U.S. cannabis brings hope for operational improvements in the sector, it’s highly uncertain—and speculative—how much this will actually impact TLRY, since its core cannabis operations are outside the U.S. Furthermore, the company’s prolonged dilution, which has still failed to deliver the desired synergies from stable top-line growth, has largely fallen short—and this trend is unlikely to reverse in the upcoming reports this year.

Given that the market has repriced TLRY at roughly 3x its value from just a few months ago, driven solely by news rather than clear improvements in fundamentals, I see this reduction in perceived risk as exaggerated, potentially placing TLRY in overvalued territory. For these reasons, I view TLRY as a Sell, anticipating further downside ahead.