Shares of Tilray (NASDAQ:TLRY) fell in after-hours trading after the company reported earnings for its third quarter of Fiscal Year 2023. Earnings per share came in at -$0.04, which beat analysts’ consensus estimate of -$0.05 per share. Sales decreased by 4.1% year-over-year, with revenue hitting $145.59 million. This missed analysts’ expectations of $150.13 million.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

As disappointing as Tilray’s earnings report was, Tilray did something to hit Hexo Corp. (NASDAQ:HEXO) even harder. Hexo plummeted over 22% in after-hours trading after Tilray confirmed it would acquire Hexo, and at a bargain price. The all-stock deal requires Tilray to offer up 0.4352 shares of Tilray for every one share of Hexo Corp. That suggests a purchase price of around $1.25 per share, around 24% less than Hexo closing price on Monday.

Tilray did make some gains, even amid its losses. Distribution revenue was up 5% against the same time last year, reaching $65.4 million. Using constant currency, however, revenue was actually up 12%, reaching $70.1 million. Tilray’s cannabis profits reached $22.2 million gross, up from $18 million in a quarter-over-quarter comparison. Adjusted gross margin percentage shot up, going from 33% to 47%. Tilray even managed to post $22 million in run-rate savings, working to keep up with a $30 million cost optimization plan.

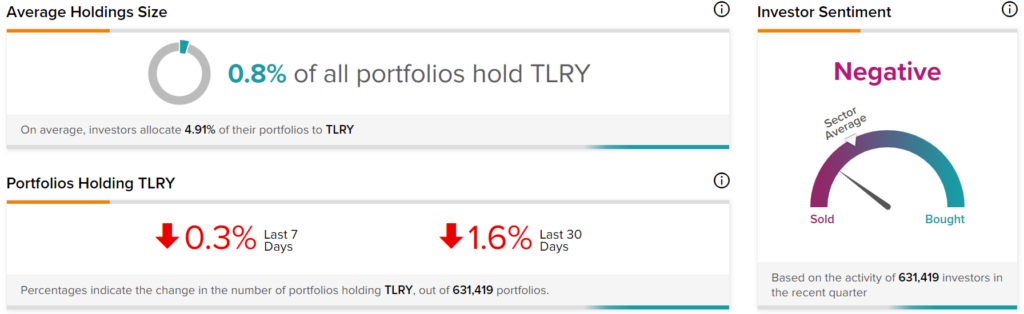

The sentiment among TipRanks investors is currently negative. Out of the 631,419 portfolios tracked by TipRanks, 0.8% hold TLRY stock. Nonetheless, the average portfolio weighting allocated towards TLRY among those who do have a position is 4.91%. This suggests that investors are fairly confident about the future.