One of ProFrac Holding’s (NASDAQ:ACDC) major corporate insiders recently bought ACDC stock worth $3.8 million. The company provides hydraulic fracturing, completion services, and other services to upstream oil and gas companies in North America.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

According to the TipRanks insider trading tool, THRC Holdings, LP, owner of more than 10% of ACDC stock, bought 285,059 shares of the company at a weighted average price of $13.40 per share on June 13 and June 14.

It is worth highlighting that the firm has been consistently increasing holdings in ACDC since May 2023. In fact, earlier this week THRC disclosed to have bought 501,939 shares of ProFrac for $6.2 million. Additionally, the total value of its holdings now stands at about $968.53 million.

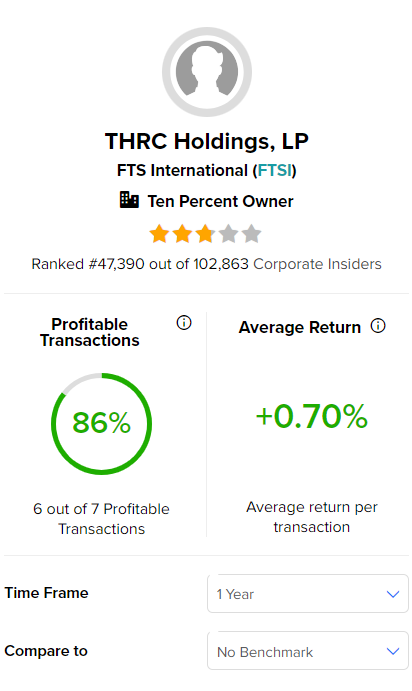

As per the data collected by TipRanks, THRC has had a commendable success rate of 86% in its seven transactions over the past year, with an average of 0.7% return per transaction.

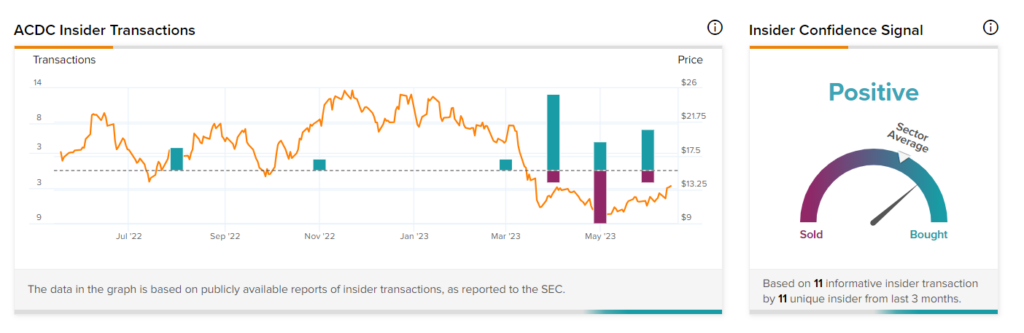

Bullish Insider Confidence Signal

Overall, corporate insiders have bought ACDC shares worth $41.9 million over the last three months. TipRanks’ Insider Trading Activity Tool shows that insider confidence in ProFrac is currently Positive.

TipRanks offers daily insider transactions as well as a list of the top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

Is ACDC a Good Stock to Buy?

The company’s efforts to diversify its offerings and grow rapidly through acquisitions are encouraging. Moreover, its vertical integration within the upstream sector and presence in three key shale basins keep it well poised for growth. However, ACDC faces the risk of a decline in commodity prices in the event of a potential recession.

Overall, ACDC stock has a Moderate Buy consensus rating on TipRanks. This is based on two Buy and two Hold recommendations. The average price target of $17.50 implies 27.6% upside potential.