Carl Icahn, who owns more than 10% of Southwest Gas (NYSE:SWX) shares, has made significant purchases over the past few days. While the billionaire investor is bullish about the company, all three analysts remain on the sidelines as they continue to be wary of the company’s volatile past performance.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Southwest Gas engages in the energy business and operates through two business segments: Natural Gas Operations and Utility Infrastructure Services.

As per the SEC filing, Icahn bought 525,064 shares of the company at a weighted average price of $60.24 per share in multiple transactions between March 21 and March 23. Excluding this latest purchase, Icahn bought 3,076,376 shares of SWX stock this month. The total value of SWX stock in Icahn’s portfolio currently stands at $619.3 million.

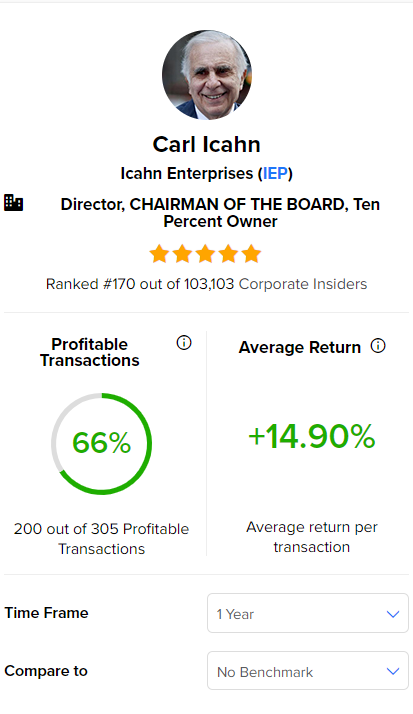

As per TipRanks, Icahn has a 66% success rate based on 305 transactions, with an average return per transaction of 14.9%.

Interestingly, TipRanks offers daily insider transactions as well as a list of top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

Is SWX a Good Stock?

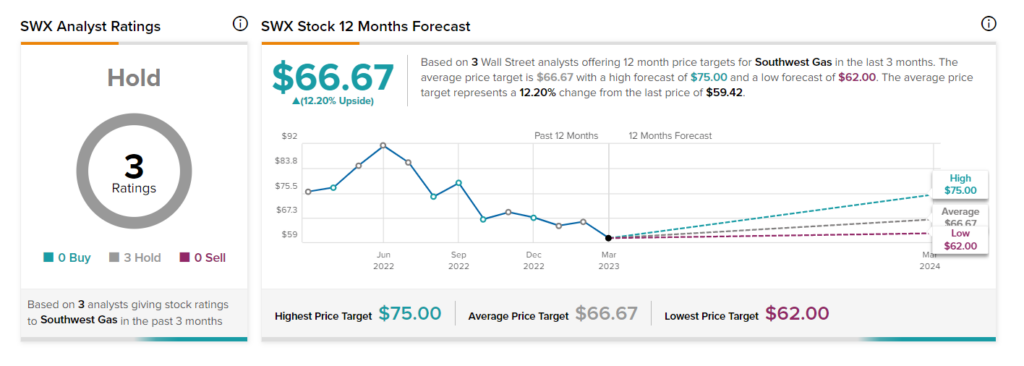

Wall Street is sidelined on SWX stock, with a Hold consensus rating based on three Holds. The average stock price target of $66.67 implies a possible upside of 12.2% from current levels.