Shares of medical technology company TransMedics Group (NASDAQ:TMDX) have been on a tear all through 2022 and the gains could possibly keep on coming.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

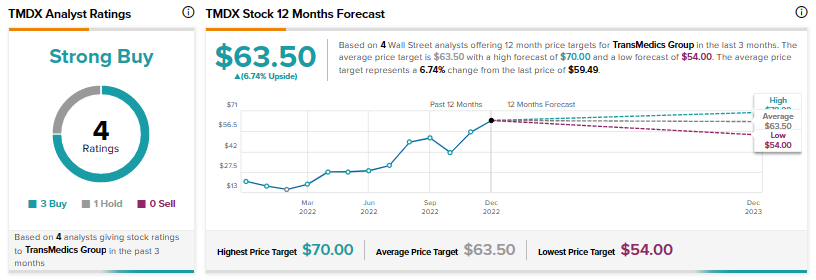

TMDX shares have risen a massive 183% so far in 2022 and analysts continue to remain gung ho about the stock with a Strong Buy consensus rating alongside an average price target of $63.50.

Cowen & Co’s Josh Jennings has reiterated a Buy rating on TMDX with a price target of $70. This indicates a further 17.67% upside in the stock on top of the gains it has already delivered for investors.

The company is a leader in assessing donor organs for transplants and in portable extracorporeal warm perfusion. Its solutions help preserve organ quality and increase the utilization of organs for settings including end-stage heart, lung, and liver failure.

These offerings have helped TMDX boost its top line from $13 million in 2018 to ~$30 million in 2021. The figure is further expected to rise to ~$133 million in 2023.

Not surprisingly then, the Street as well as investors remain upbeat about TMDX. At present, with an enterprise value-to-revenue ratio of 24.56, TMDX isn’t exactly inexpensive at current levels.

Special end-of-year offer: Access TipRanks Premium tools for an all-time low price! Click to learn more.

Read full Disclosure