Shares of Strategy (MSTR) are rallying in today’s trading after the Bitcoin-focused company founded by Michael Saylor announced it will no longer be subject to the U.S. corporate alternative minimum tax (AMT). This tax, which applies to large corporations with over $1 billion in income over a three-year period, was originally expected to impact Strategy starting in 2026 due to Bitcoin’s strong performance this year.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

However, new guidance released Tuesday by the Department of the Treasury and the IRS changes how digital assets are treated under the AMT. Indeed, the interim rule says that companies can ignore unrealized gains and losses on digital assets, such as Bitcoin, when calculating whether they owe the tax. Thanks to this update, Strategy believes it won’t meet the threshold for the 15% corporate AMT after all, according to its latest regulatory filing.

It is also worth noting that the company began using updated accounting rules in January that require Bitcoin holdings to be marked to market, meaning changes in Bitcoin’s value directly affect reported earnings. Because of this, Strategy reported an $8.1 billion unrealized gain on Bitcoin for the first half of 2024. Interestingly, as of June 30, the company holds roughly $74.6 billion worth of Bitcoin.

Is MSTR Stock a Good Buy?

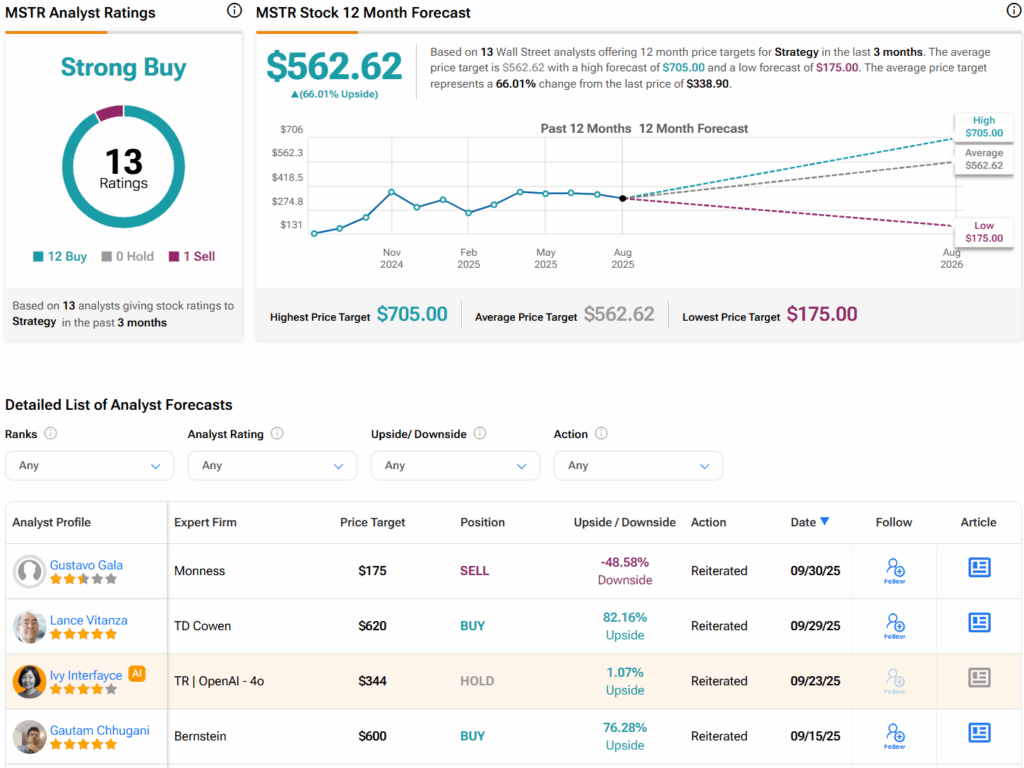

Turning to Wall Street, analysts have a Strong Buy consensus rating on MSTR stock based on 12 Buys, zero Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average MSTR price target of $562.62 per share implies 66% upside potential.