Shares of investing platform Robinhood (HOOD) jumped on Monday after analysts at Compass Point raised their price target from $105 to $161 per share. The upgrade was due to strong revenue growth from equity trades, crypto fees, and prediction markets. In addition, analyst Ed Engel and his team kept a Buy rating on the stock and said they expect Robinhood to report October trends that are tracking well above what investors are expecting for the fourth quarter.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

A big part of that growth comes from Robinhood’s prediction markets, a new feature launched earlier this year. For context, it lets users place bets on the outcome of major events, such as football games, political developments, or where Bitcoin’s price will land. Engel estimates that the company made about $20 million from prediction markets in Q3, which would be more than double that of the prior quarter. Notably, CEO Vlad Tenev said that over two billion prediction contracts were issued in Q3, out of a total of four billion since the feature launched. This equates to about $40 million in revenue at $0.01 per contract.

Engel believes that number could rise to $50 million in Q4 now that the full NFL season is underway. He also expects Robinhood’s crypto revenue to grow due to higher transaction fees and services like staking, which let users earn rewards by locking up their tokens. As a result, Engel believes that Wall Street may be underestimating Robinhood’s crypto revenue for the second half of 2025 and for 2026. Nevertheless, investors will get a better idea when the company releases its earnings next Wednesday after the market closes.

Is Robinhood Stock a Good Buy?

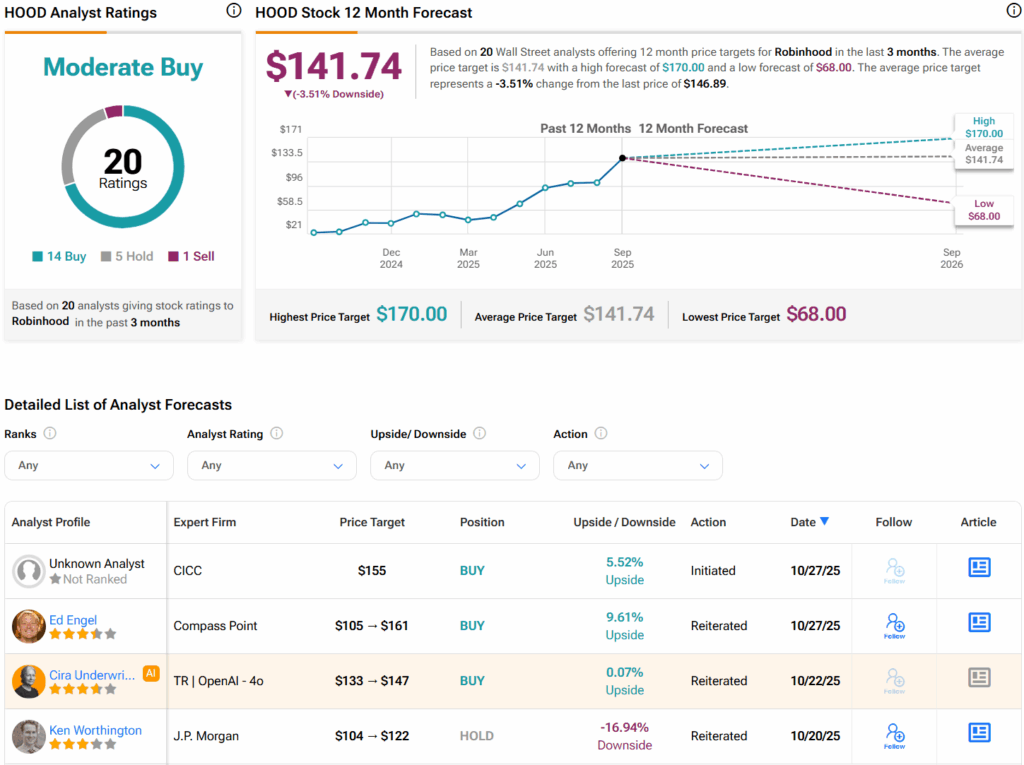

Overall, analysts have a Moderate Buy consensus rating on HOOD stock based on 14 Buys, five Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average HOOD price target of $141.74 per share implies 3.5% downside risk.