Shares of CoreWeave (CRWV) surged today after the AI infrastructure firm introduced new tools to help developers build AI agents. One of the key launches is a serverless reinforcement learning (RL) service that automatically adjusts computing power, thereby making it easier for users to scale without managing infrastructure. According to the company, tests show that the service can train models faster and at 40% lower cost compared to running Nvidia H100 GPUs locally, without affecting model quality.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Notably, Reinforcement learning, which helps AI improve through trial and error, has been around for decades but has traditionally required expensive infrastructure and deep technical expertise. However, the new RL service helps overcome these barriers. In addition, it comes five months after CoreWeave acquired Weights & Biases for $1 billion, and complements its core business of renting out Nvidia (NVDA) GPUs to companies that need computing power to run large-scale AI models.

It’s also worth noting that demand for GPUs and AI infrastructure has surged. In fact, just two weeks ago, OpenAI (PC:OPAIQ) expanded its deal with CoreWeave by up to $6.5 billion, while Meta committed $14.2 billion last week. Separately, in July, CoreWeave announced plans to buy data center provider Core Scientific for $9 billion, though some shareholders have pushed back, asking for a better offer. Despite the pressure, CEO Mike Intrator made it clear that the deal will not be renegotiated.

Is CRWV Stock a Good Buy?

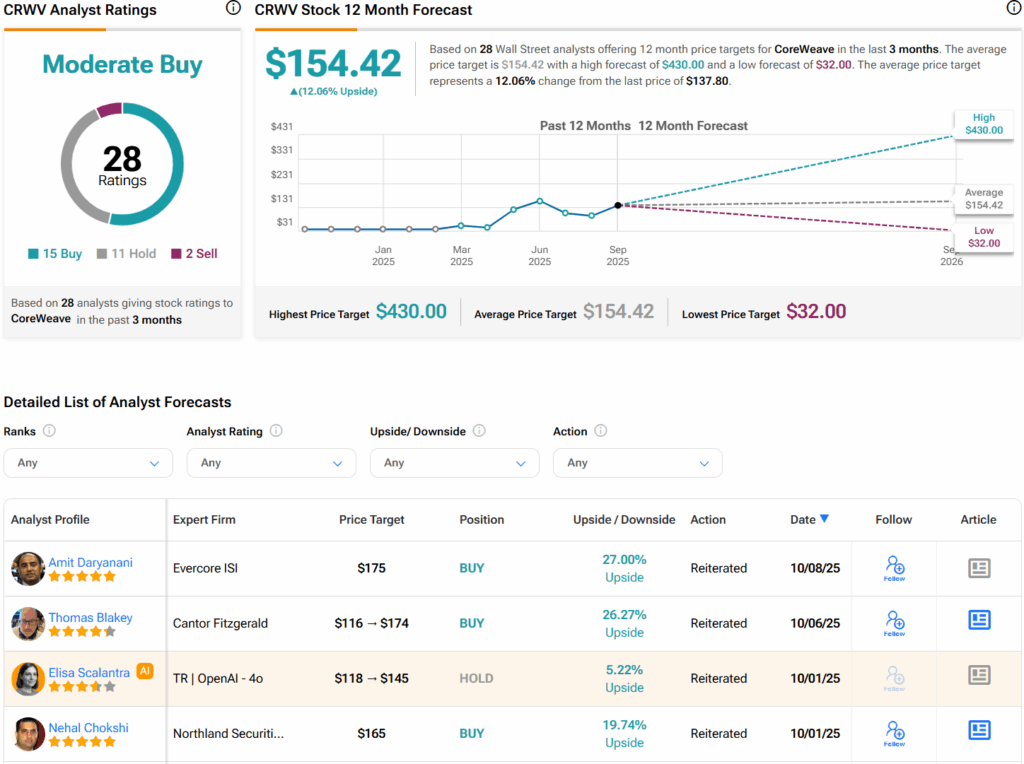

Turning to Wall Street, analysts have a Moderate Buy consensus rating on CRWV stock based on 15 Buys, 11 Holds, and two Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average CRWV price target of $154.42 per share implies 12.1% upside potential.