Shares of Bitdeer Technologies (BTDR), a crypto mining and AI infrastructure company, surged nearly 29% on Wednesday, hitting a new all-time high of around $27.80 per share. The key driver was the company’s focus on expanding its presence in the AI data center market.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Factors Leading to BTDR Stock’s Surge

Bitdeer disclosed plans to make its Clarington, Ohio, facility capable of supporting both Bitcoin mining and AI workloads. It confirmed that 570 megawatts of power will be available by Q3 2026, nearly a year ahead of schedule.

BTDR also plans to convert its Tydal and Wenatchee sites into AI-ready centers. The move is driven by the growing demand and limited market supply for AI computing power.

The impressive surge was aided by some other factors as well. The company’s core mining business is witnessing investor optimism as Bitcoin climbed past $111,000. BTDR recently disclosed that it mined 452 BTC in September, up 20.5% sequentially, backed by its expanding self-mining fleet.

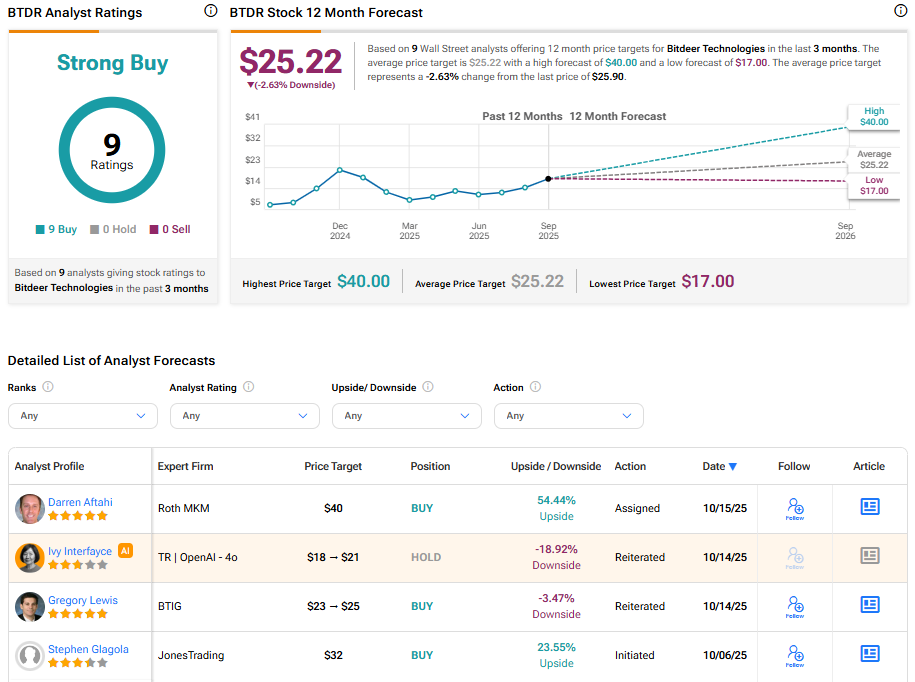

Also, earlier today, Roth MKM analyst Darren Aftahi reiterated a Buy rating on BTDR stock and projects a 54% upside potential from the current price. Institutional interest is also rising, with fund ownership jumping nearly 39% last quarter.

Is BTDR a Good Stock to Buy?

Turning to Wall Street, BTDR stock has a Strong Buy consensus rating based on nine unanimous Buys assigned in the last three months. At $25.22, the average Bitdeer stock price target implies a 2.63% downside risk.