Retailers are starting to use artificial intelligence in order to save money and boost profits. Indeed, Morgan Stanley analyst Alex Straton says that agentic AI—AI that can act on its own—could help big U.S. retailers save around $6 billion each year by 2026, thanks to tools that improve inventory planning, automate supply chains, and handle customer service. As a result, that could increase profits by up to 20%. Interestingly, the companies most likely to benefit from this are Gap (GAP), Macy’s (M), and Victoria’s Secret (VSCO).

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Straton used two ways to measure how ready companies are: one based on potential savings from AI, and another based on how often they talk about AI in earnings calls. If these AI tools work as expected, the whole retail sector could see profit margins go up by about 2%. However, not everyone is sure the numbers will turn out that well. For instance, Morningstar analyst David Swartz told Yahoo Finance that it’s still unclear how exactly AI will save money, since most companies haven’t shared clear data.

Swartz agrees that AI could help with things like marketing, customer targeting, coupons, and product design. But he believes the most useful part of AI might be helping stores figure out how much of each product to order. That could reduce waste and markdowns, which have long been a problem in retail. However, Straton notes that so far, AI hasn’t made much of a difference in how well retailers manage their inventory. And while AI may bring steady improvements over time, both experts warn that it won’t suddenly transform the retail world.

Which Retailer Is the Better Buy?

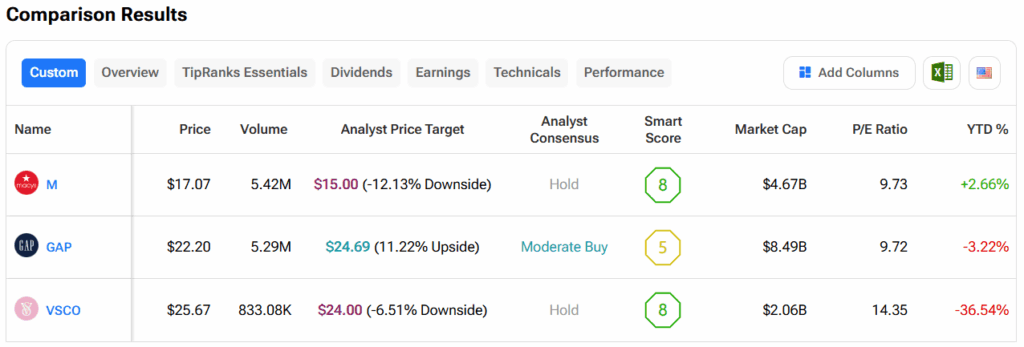

Turning to Wall Street, out of the three stocks mentioned above, analysts think that GAP stock has the most room to run. In fact, GAP’s average price target of $24.69 per share implies more than 11% upside potential. On the other hand, analysts expect the least from M stock, as its average price target of $15 equates to a loss of 12.1%.