Amazon (NASDAQ:AMZN) hasn’t exactly been one of the highflyers in 2025, and its share price is pretty much even year-to-date.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

It has been a good many years since Amazon could be described as simply an e-commerce company, and its record of plowing money into R&D has helped it become a true technological behemoth. Even so, the tariff worries that buffeted the markets certainly did a number on AMZN’s share price, which went southward during the early part of 2025.

In contrast, however, AMZN has been riding a nice swell of momentum of late, and its share price has risen some 15% over the last six months.

Its latest earnings reflected a company operating with a full tank of gas, as its revenues of $167.7 billion represented year-over-year growth of 13%. Amazon Web Services grew at an even greater pace, with $30.9 billion in revenues an increase of 17.5% year-over-year.

Top investor Geoffrey Seiler predicts that the company is well-placed to emerge in prime position in the quarters ahead.

“The company has a history of investing big to win big, and it’s no different now with AI. With a lot of good things happening under the hood, the stock looks like a no-brainer buy at current levels,” says the 5-star investor, who is among the top 2% of stock pros covered by TipRanks.

Seiler points out that Amazon now serves as a “hub” for AI development, with multiple technological solutions that customers are plugging into to customize, train, and deploy their own models. The company is also in the hardware space, having developed its own AI chips.

Of course, AMZN’s retail roots remain ever-present, a potent combo with its AI prowess. This includes robots throughout its fulfillment centers, notes the investor, which are moving boxes and detecting damaged goods, among other tasks.

“Amazon is embedding AI across its entire e-commerce ecosystem. This is where a lot of the company’s earnings growth could come from in the years ahead,” predicts Seiler.

In other words, the company’s “laggard” year could be an opportunity for savvy investors, according to Seiler.

“With Amazon’s stock flat on the year, now looks like a great time to scoop up shares,” sums up the investor. (To watch Geoffrey Seiler’s track record, click here)

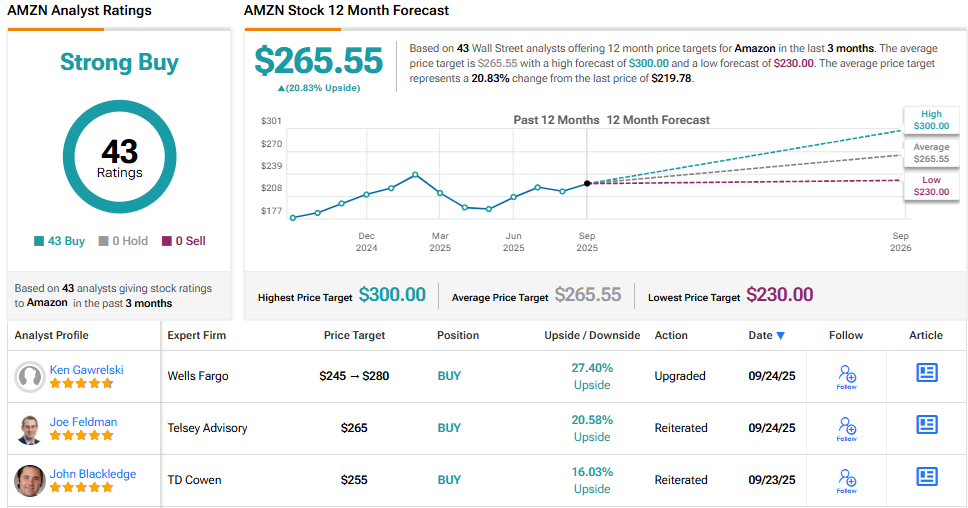

Wall Street is in full agreement with the investor. In fact, AMZN is one of those rare birds with zero dissent – and 43 Buys and nary a single Hold nor Sell give it a Strong Buy consensus rating. Its 12-month average price target of $265.55 implies gains north of 20% in the year ahead. (See AMZN stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.