With more than $100 billion in planned capex spending slated for 2025, clearly Amazon (NASDAQ:AMZN)‘s commitment to AI is no mere lip service.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

But just because AI is front and center in the company’s future doesn’t mean that Amazon is neglecting its legacy business of e-commerce. In fact, the company recently introduced Add to Delivery, which allows its Prime members to add eligible items to their next scheduled delivery.

However, with billions of dollars being spent every quarter on AI capabilities, is this development worth getting excited over? Absolutely, argues investor John Bromels, who dismisses claims that this is simply a “marginal improvement.”

“Add-on items represent almost pure net profit for Amazon, since most expenses are already accounted for,” exclaims the 5-star investor.

Bromels notes that the largest portion of online shopping in the U.S. starts on Amazon, and its Prime service has developed a loyal clientele. If speed is your priority, the investor points out that Amazon is almost always your best option.

“Amazon has unparalleled internal logistics and a huge in-house delivery network that doesn’t require it to rely on outside shippers for speedy deliveries,” emphasizes Bromels.

The investor adds that, according to Amazon, Prime members made nearly 100 orders in 2024. In other words, on average these consumers have at least one package set to arrive every few days.

Sweetening the deal, adding new items to an existing delivery will be cost effective for the company, says Bromels. Amazon is already paying for the delivery costs such as the driver’s wages and fuel expenses.

This could be a game changer for Amazon’s e-commerce business and its “very low margins,” adds Bromels.

For instance, the investor estimates that just $5 in extra net sales per year from its Prime customers would translate into an extra $1 billion in revenues. According to Bromels’ calculations, this would represent a 4% increase to the North American e-commerce unit’s bottom line.

“It’s easy to see how this small upgrade could have a very big effect on earnings,” concludes Bromels. (To watch John Bromels’ track record, click here)

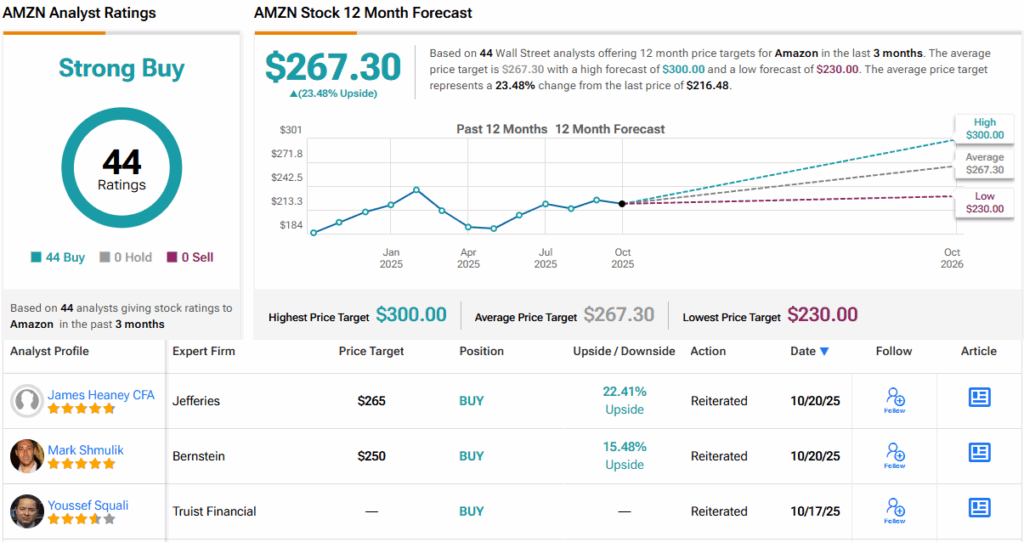

Over on Wall Street, Amazon is one of those rare birds where everyone seems to agree. With 44 Buys and nary a single Hold or Sell, AMZN cruises to a Strong Buy consensus rating. Its 12-month average price target of $267.30 points to an upside of ~23%. (See AMZN stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.