Kelcy L. Warren, executive chairman of Energy Transfer’s (NYSE:ET) board of directors, increased his stake in the company by purchasing 1.3 million shares on November 23 at an average price of $12.39 per share. The transaction’s total consideration stands at $16.1 million.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Headquartered in Texas, Energy Transfer is a provider of natural gas pipeline transportation and transmission services.

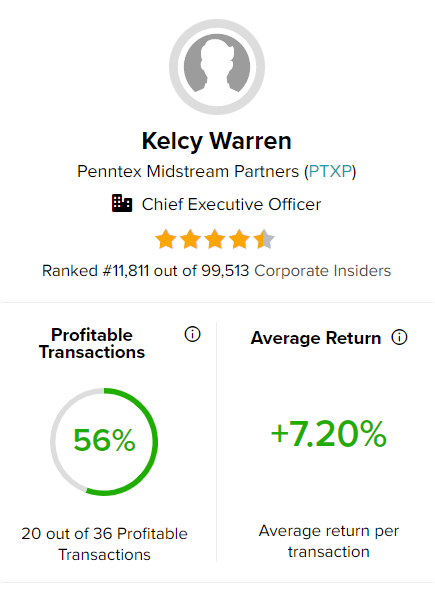

As per the data collected by TipRanks, Warren has been consistently increasing his holdings in ET stock since August 10, 2022. The total value of its holdings now stands at about $3.56 billion. Interestingly, Warren has had a 56% success rate in his 36 transactions so far, with an average 7.2% return per transaction.

Overall, corporate insiders have bought ET shares worth $73.2 million over the last three months. TipRanks’ Insider Trading Activity Tool shows that insider confidence in Energy Transfer stock is currently Positive.

TipRanks offers daily insider transactions as well as a list of top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

Is ET a Good Stock to Buy?

On TipRanks, ET stock commands a Strong Buy consensus rating based on five unanimous Buys. The average Energy Transfer stock price target of $16.80 implies 38.27% upside potential.

It is worth noting that ET is currently trading at a price/sales ratio of 0.43x, reflecting a slight discount from its five-year average of 0.45. This discounted valuation could be considered a buying opportunity for the stock. Also, Energy Transfer sports a “Perfect 10” Smart Score, implying it has the potential to beat the broader market averages.