Q-GRG VII (CP) Investment Partners, LLC, more than 10% owner of ChargePoint Holdings (NYSE:CHPT), increased its stake in the company by purchasing 1,436,377 shares on December 27 and December 28 at an average price of $8.28 per share. The transaction’s total consideration stands at $11.9 million.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

ChargePoint provides networked charging systems and cloud-based software and services to residential and commercial customers, as well as fleet operators.

As per the data collected by TipRanks, Q-GRG VII (CP) Investment Partners has had a 100% success rate over the past year, with an average 33% return per transaction.

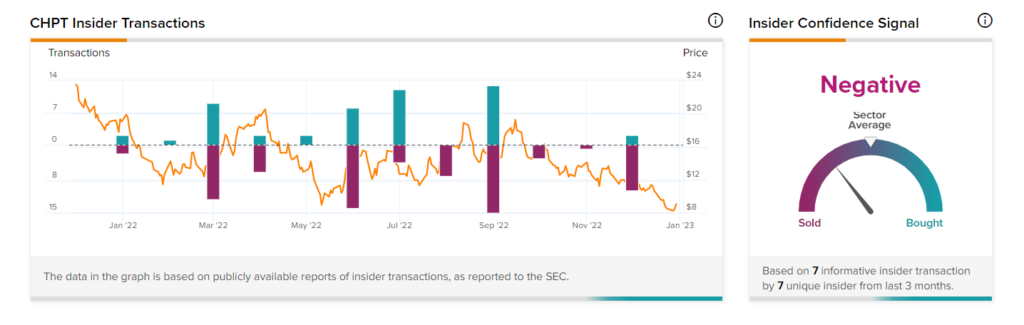

Another insider transaction worth mentioning is that of Michael Linse, who also holds more than 10% of ChargePoint, and is one of the company’s Directors. He sold 66,803 CHPT shares at $9.98 per share on December 19.

Overall, corporate insiders have bought CHPT shares worth $11.2 million over the last three months. TipRanks’ Insider Trading Activity Tool shows that insider confidence in ChargePoint stock is currently Negative.

TipRanks offers daily insider transactions as well as a list of top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

Is CHPT a Good Stock to Buy?

On TipRanks, CHPT stock commands a Strong Buy consensus rating based on six Buys and two Holds. The average ChargePoint stock price target of $19.38 implies 114.38% upside potential.

Moreover, hedge funds also increased their holdings of CHPT stock by 1.9K shares in the last quarter. Overall, CHPT scores 8 out of 10 on TipRanks’ Smart Score rating system, pointing to its potential to outperform.

Special end-of-year offer: Access TipRanks Premium tools for an all-time low price! Click to learn more.