A Director of V2X (NYSE:VVX), Dino MCusumano, has lapped up the company’s shares worth $15 million in several transactions made during this week, according to an SEC filing released yesterday.

Headquartered in Colorado, U.S., V2X Inc. is a newly formed company that is the result of a merger of equals between public entity Vectrus and privately-held Vertex, which took place in July 2022.

The newly formed company offers comprehensive mission support services and solutions for defense and national security customers worldwide, including logistics.

Shares of VVX have gained almost 20% in the last five trading days. However, they closed 2.9% lower yesterday at $40.06.

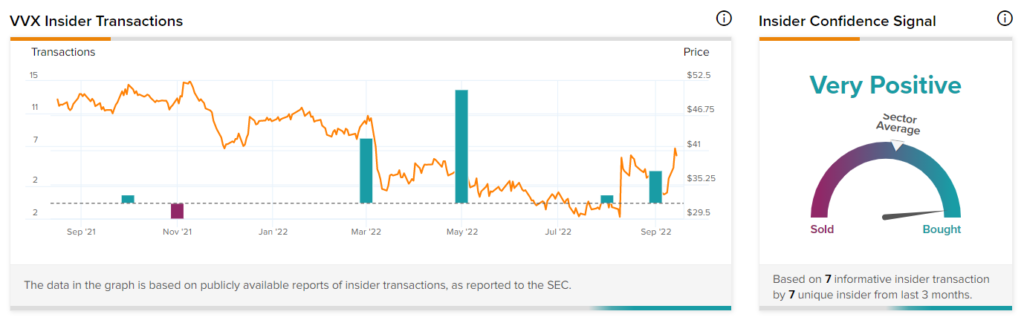

TipRanks’ Insider Trading Tool shows Insiders at V2X are clearly optimistic about the stock’s near-term prospects and have bought VVX stock worth a whopping $15.1 million in the last three months.

The tool also shows that the Insider Confidence Signal is currently Very Positive for V2X, with corporate insiders buying VVX stock recently.

Interestingly, TipRanks also provides a list of hot stocks that boasts either a Very Positive or Positive insider confidence signal.

Is VVX Stock a Buy, Sell, or Hold?

The Wall Street community is clearly optimistic about the prospects of VVX stock. Overall, the stock commands a Strong Buy consensus rating based on three unanimous Buys. V2X’s average price target of $52.33 implies 30.63% upside potential from current levels.

Raymond James analyst Brian Gesuale is also very bullish on VVX. On September 9, he initiated coverage on V2X with a Buy rating and a price target of $50 (24.81% upside potential).

Gesuale believes that V2X is immensely undervalued at current levels. The analyst thinks that the stock is at an inflection point based on “favorable defense spending backdrop” as well as increased “geopolitical instability driving an increased forward military posture for the first time since 2011 that drives base operations spend globally”.

Lastly, VVX stock boasts a score of eight out of 10 on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Read full Disclosure