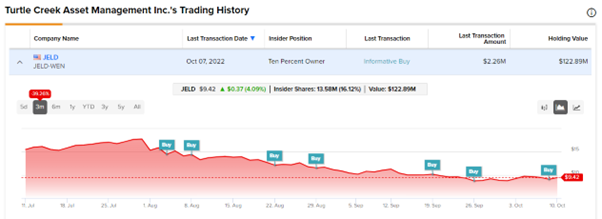

Shares of JELD-WEN Holding Inc (NYSE: JELD) gained over 4% yesterday on insider trading news. One of the major owners, Turtle Creek Asset Management, bought 240,150 shares at an average price of $9.41 per share, worth $2.26 million on October 7.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

However, shares of the company traded 4% lower in the after-hours session on the news that JELD-WEN offered a block of 3 million shares through Bank of America.

Based in the U.S., JELD-WEN Holding, Inc. manufactures and sells doors, windows, and related products.

It is important to note that Turtle Creek has been steadily buying company shares in several small and big transactions over the last quarter. Including the recent Buys, the firm now owns 16.12% (13.58 million shares) of the total shares outstanding with a value of $122.89 million.

Notably, there are other insiders as well that have been steadily lapping up shares of JELD-WEN over the past quarter.

Overall, TipRanks’ Insider Trading Tool shows Insiders at JELD are clearly optimistic about the stock’s near-term prospects and have bought JELD stock worth $4.7 million in the last three months.

The tool also shows that the Insider Confidence Signal is currently Very Positive for JELD, with corporate insiders buying JELD stock recently.

Interestingly, TipRanks also provides a list of hot stocks that boasts either a Very Positive or Positive insider confidence signal.

Is JELD a Buy?

JELD stock has received two Buy, six Hold, and two Sell recommendations for a Hold consensus rating. JELD-WEN stock’s average price target of $15.45 implies 64.01% upside potential from current levels.

Also, JELD stock has a very positive signal from hedge fund managers, who added 2.4 million shares during the last quarter.

Read full Disclosure