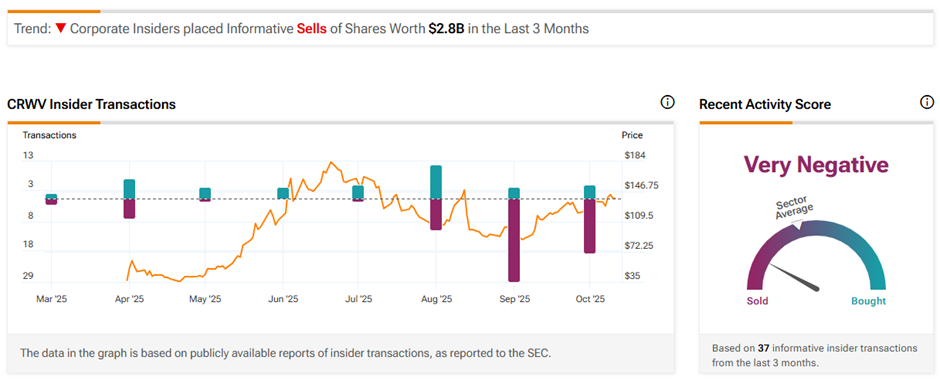

Magnetar Financial LLC, a majority shareholder (more than 10% owner) of CoreWeave (CRWV), has undertaken massive stock sales over the past couple of days. Between October 8 and 10, Magnetar sold approximately $334.87 million worth of common stock, sparking concern among retail investors. CoreWeave is a cloud infrastructure company offering services that enable high-performance computing (HPC) in the artificial intelligence and blockchain space.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

This sale marks Magnetar’s eleventh consecutive transaction of CRWV stock since the IPO lock-up period expired. To date, the firm has sold more than $2 billion worth of CoreWeave shares but still holds stock worth $1.41 billion. These shares were indirectly held by several of Magnetar’s funds, including Magnetar Financial LLC, Magnetar Capital Partners LP, and Supernova Management LLC.

Should CoreWeave Investors Worry?

Many CoreWeave IPO investors have sold billions of dollars’ worth of shares since mid-August. Following its highly successful IPO in March 2025, the company’s stock has skyrocketed nearly 273%, reflecting surging demand for AI and GPU-based cloud services. Despite its impressive growth, the stock remains a high-risk investment, and investors should carefully assess their risk tolerance before buying in.

Insider share sales usually indicate caution about a company’s future, but can also happen for personal reasons. Hence, it is important to watch these trades for clues on the company’s growth expectations.

A Closer Look at the Insider’s Transactions

According to five Form 4 filings with the SEC on October 10, Magnetar Financial sold a total of 2,359,599 CRWV shares between October 8 and 10. These shares were sold in multiple tranches at weighted average prices ranging between $138.46 and $151.31 apiece.

Currently, CRWV stock carries a Very Negative Insider Confidence Signal on TipRanks, based on Informative Sell transactions exceeding $2.8 billion, undertaken in the last three months.

Is CRWV a Good Investment?

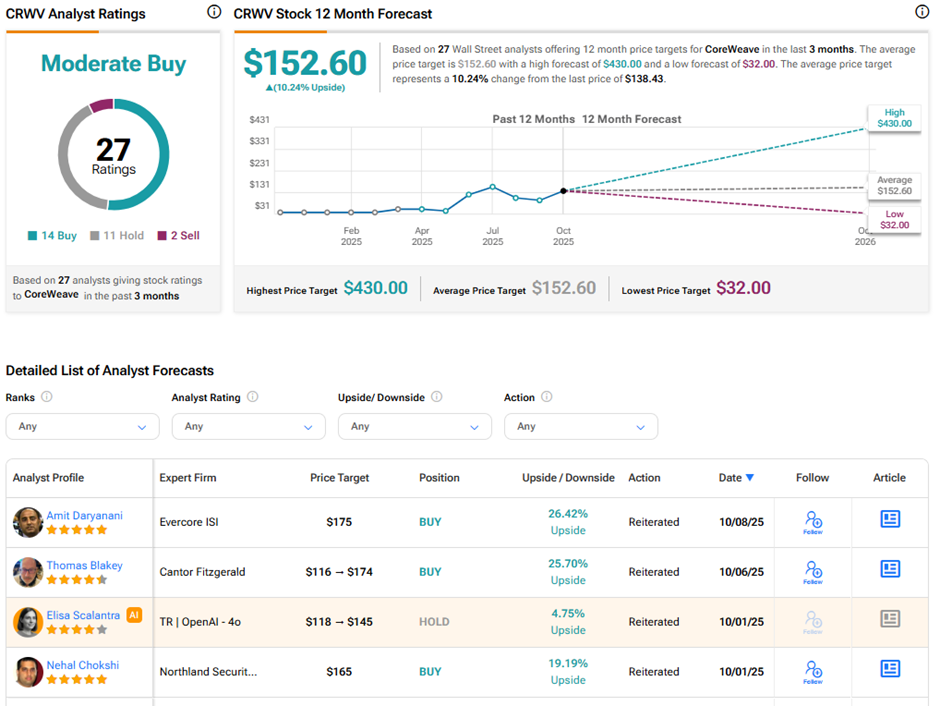

Analysts remain divided on CoreWeave’s long-term outlook. On TipRanks, CRWV stock has a Moderate Buy consensus rating based on 14 Buys, 11 Holds, and two Sell ratings. The average CoreWeave price target of $152.60 implies 10.2% upside potential from current levels.