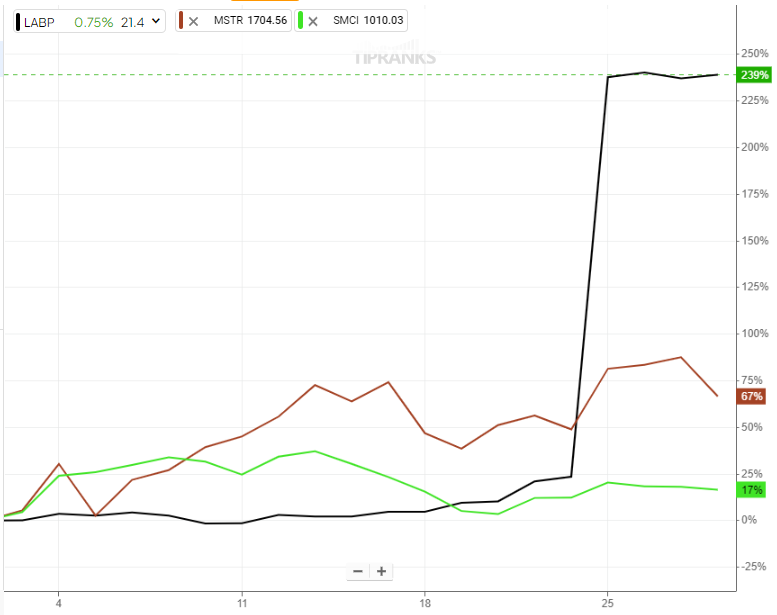

Shares of MicroStrategy (NASDAQ:MSTR) and Super Micro Computer (NASDAQ:SMCI) have delivered exceptional gains year-to-date. Maintaining the uptrend, MSTR stock gained about 67% in March 2024, while SMCI appreciated nearly 17%. Despite the ongoing rally, these stocks have failed to keep up with the gains of Landos Biopharma (NASDAQ:LABP), a clinical-stage biopharmaceutical company developing oral therapeutics for patients with autoimmune diseases.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Notably, LABP stock has gained about 239% in March. This massive growth came after pharmaceutical giant AbbVie (NYSE:ABBV) announced the acquisition of LABP on March 25. AbbVie is acquiring Landos Biopharma at a significant premium.

While LABP outperformed MSTR and SMCI stocks with its gains, the optimism remains capped as it has agreed to be acquired by ABBV. In the meantime, let’s look at Wall Street’s expectations for MSTR and SMCI stock.

Is MSTR a Good Stock to Buy?

Shares of MicroStrategy, which provides artificial intelligence (AI)- powered enterprise analytics software, are up about 170% year-to-date. Notably, the company leverages its cash to accumulate Bitcoin (BTC-USD). Thus, MSTR stock’s performance is closely tied to the movement in Bitcoin prices. As Bitcoin continues to trend higher, MSTR stock is hitting new highs.

Analysts are bullish about MSTR’s prospects, reflecting investors’ optimism over Bitcoin and the significant increase in the company’s Bitcoin holdings. All four analysts covering MSTR stock recommend a Buy. As the stock has gained quite a lot, analysts’ average price target on MSTR stock is $1,346.67, implying 21% downside potential from current levels.

What is the Future of SMCI Stock?

Super Micro Computer provides high-performance server and storage solutions. The widespread application of AI has significantly driven demand for its offerings. The company’s AI infrastructure products continue to witness solid demand, which should drive its future revenue and earnings. Further, SMCI is winning new customers, which is encouraging.

However, as SMCI stock is up over 255% year-to-date, analysts maintain a cautiously optimistic outlook. SMCI stock has a Moderate Buy consensus rating, reflecting seven Buy, three Hold, and one Sell recommendations. Analysts’ average price target on SMCI stock is $965.64, implying a 4.39% downside potential from current levels.