Software company Palantir Technologies (NYSE:PLTR) disclosed that Peter Thiel’s venture capital fund, Mithril, sold PLTR stock worth over $48 million. Per the SEC filing, Mithril had initially acquired Palantir stock through various transactions spanning from December 21, 2012, to December 31, 2012, and via a direct share offering on November 20, 2013.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Peter Thiel, who cofounded Mithril, is also one of the co-founders of Palantir. He is also one of the earliest investors in Meta Platforms (NASDAQ:META), previously known as Facebook.

Notably, the stock sale process coincides with the impressive year-to-date run in Palantir stock. Shares of this software company have risen almost 208% so far this year. Investors remain upbeat about Palantir’s ability to capitalize on the growing AI (artificial intelligence) demand. Further, the company launched its AI platform, which augurs well for growth. With this backdrop, let’s look at the Street’s recommendations for Palantir stock.

Is Palantir a Buy, Sell, or Hold?

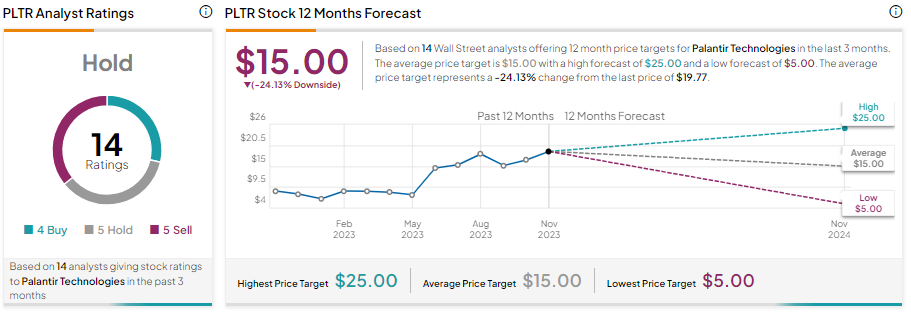

The significant rally in Palantir stock keeps analysts sidelined. PLTR stock sports a Hold consensus rating based on four Buy, five Hold, and five Sell recommendations. Further, analysts’ average price target of $15 implies 24.13% downside potential from current levels.