Shares of financial firm Charles Schwab (SCHW) have been strong in 2025 despite pressure from rising interest rates and deposit concerns earlier in the year. In addition, since releasing its Q3 2025 earnings report, the company has shown signs of strength, especially in terms of bringing in new client assets. While the broader economy and stock market still significantly influence its performance, Schwab has a mix of potential growth drivers and risks that investors should keep an eye on.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Catalysts that May Push the Stock Higher

A key reason the stock could keep climbing is Schwab’s strong growth in client assets. In Q3 2025, the company brought in $95.3 billion in core net new assets, which brought total client assets to a record $9.92 trillion. This shows that Schwab is still doing well at keeping its customers and attracting new ones. If markets stay steady or rise in 2026, Schwab could benefit from increased trading activity and higher asset-based fees.

Another reason for optimism is Schwab’s net interest income. Although higher interest rates initially caused customers to move money out of lower-yielding accounts, that pressure is starting to ease. As clients get used to current rates—and if the Federal Reserve begins cutting rates in 2026—Schwab may see funding costs drop. This would support its earnings. The company is also planning to launch direct crypto trading in 2026. If successful, this could attract younger investors and open up a new stream of revenue.

Risks to Watch Out For

It is worth noting that even with a strong Q3 performance, Schwab still has some risks to consider. For instance, the company faces growing competition from low-cost, digital-first investment platforms, which could push Schwab to lower its own fees.

Moreover, if there’s a market downturn or investors become more cautious, trading volumes might fall, reducing Schwab’s income. Lastly, while the upcoming crypto trading platform could be a growth opportunity, it also brings potential regulatory hurdles and reputational risks if not handled carefully.

Is SCHW Stock a Good Buy?

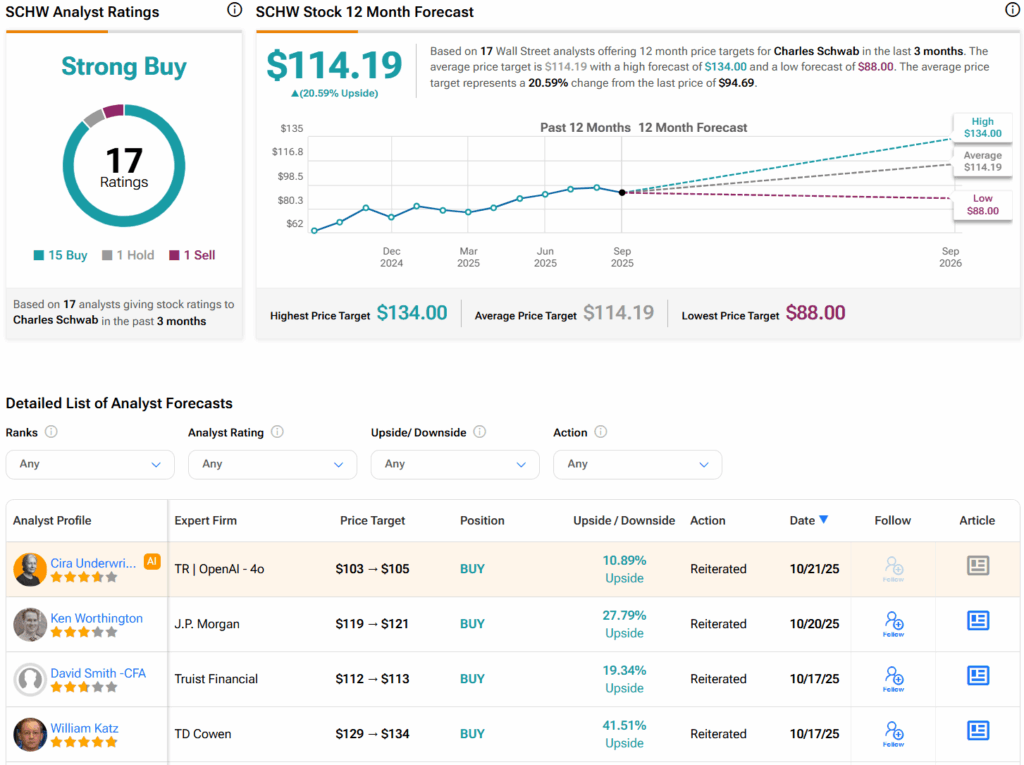

Turning to Wall Street, analysts have a Strong Buy consensus rating on SCHW stock based on 15 Buys, one Hold, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average SCHW price target of $114.19 per share implies 20.6% upside potential.