Dollar General (DG) has built its reputation as a go-to retailer for cost-conscious shoppers, especially in rural and suburban communities. Its focus on low prices and a wide store network have made it a steady presence in the discount retail space. Recently, though, the company has faced headwinds from weaker consumer spending, higher operating costs, and some missteps in execution. For investors, the stock offers a mix of promise and concern, with its outlook depending on how well management can handle current challenges while positioning the business for future growth.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Catalysts that May Push the Stock Higher

Dollar General (DG) has started 2025 on stronger footing after a tough year in 2024. In its second-quarter earnings, reported in late August, the company posted net sales growth of 5.1% from a year earlier, same-store sales up 2.8%, and earnings per share rising 9.4% to $1.86. These results were solid enough for management to raise its full-year outlook. Interestingly, a key driver has been more cost-conscious shoppers turning to Dollar General for everyday essentials.

Another major growth driver is the company’s large expansion plan. In fact, Dollar General has nearly 4,900 real estate projects scheduled for this year, including 575 new store openings and thousands of remodels. The company is especially focused on rural and underserved areas, where competition is limited and convenience matters most.

Risks to Watch Out For

However, even with these positive developments, Dollar General still faces some risks. Indeed, competition is heating up, with Walmart (WMT) and Target (TGT) using low prices to attract budget-conscious shoppers, while Dollar Tree (DLTR) is working to expand aggressively. As a result, the discount retail space is becoming more crowded, which could limit DG’s ability to raise prices or protect profitability.

At the same time, economic pressures are another concern, as high inflation and tariffs continue to weigh on consumer spending. While Dollar General benefits when shoppers “trade down,” rising costs could squeeze the company’s margins. Because DG serves many lower-income households, it is also vulnerable to economic shocks, such as cuts to government benefits or higher unemployment rates. On top of that, investor sentiment could shift if the stock market moves away from defensive names like discount retailers, particularly after DG’s recent share price recovery.

Is DG Stock a Good Buy?

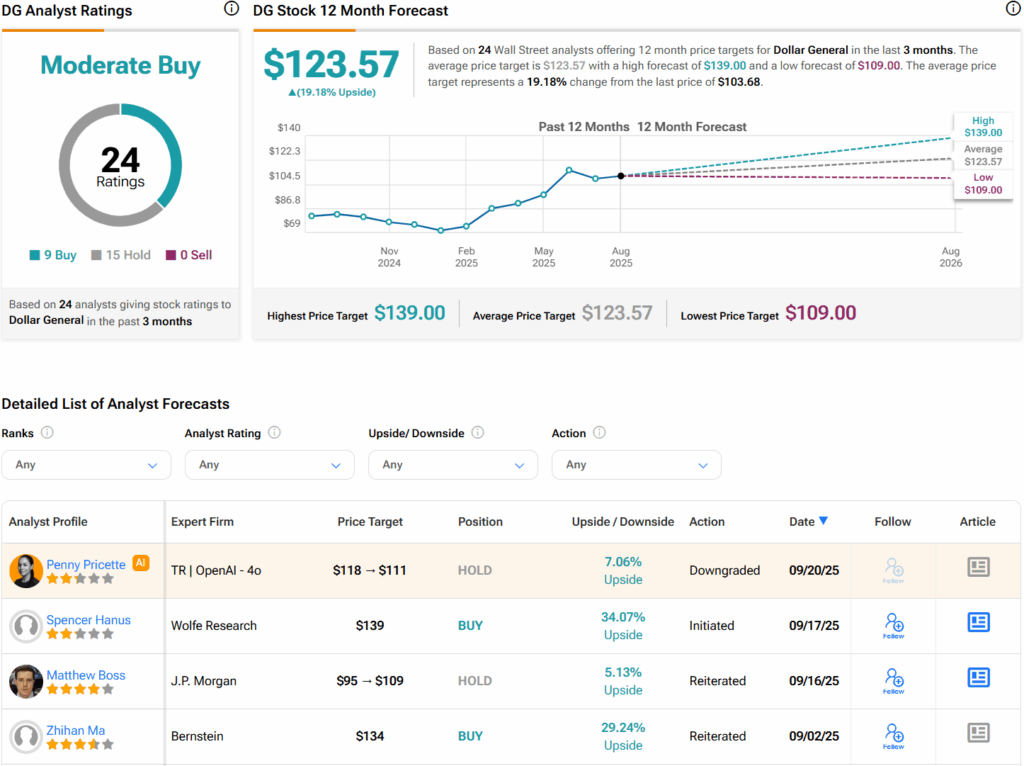

Turning to Wall Street, analysts have a Moderate Buy consensus rating on DG stock based on nine Buys, 15 Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average DG price target of $123.57 per share implies 19.2% upside potential.