Scientific instruments, equipment, reagents and consumables, and software and services provider Thermo Fisher (TMO) has reported solid second-quarter 2021 results driven by growth across all business segments. Based in Massachusetts, the company’s products are used for diagnostics, discovery, analysis and research.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Adjusted earnings per share (EPS) increased 44% year-over-year to $5.60, beating the Street’s estimate of $5.49. Quarterly revenue rose 34% to $9.27 billion, surpassing analysts’ expectations of $8.77 billion.

Life Sciences Solutions Segment revenue grew 37% year-over-year to $3.56 billion; revenue of Analytical Instruments Segment climbed 41% to $1.48 billion; Specialty Diagnostics Segment revenue surged 25% to $1.24 billion; and revenue of Laboratory Products and Services Segment jumped 29% to $3.58 billion.

The Chairman, President and CEO of Thermo Fisher, Marc N. Casper, said, “We’re in a great position at the halfway point of the year and on track to deliver an outstanding 2021.” (See Thermo Fisher stock chart on TipRanks)

Furthermore, the company has raised its revenue and earnings guidance for 2021. It lifted the revenue projection by $300 million to $35.90 billion and adjusted EPS outlook by $0.10 to $22.07. The figures represent 11% and 13% year-over-year growth, respectively.

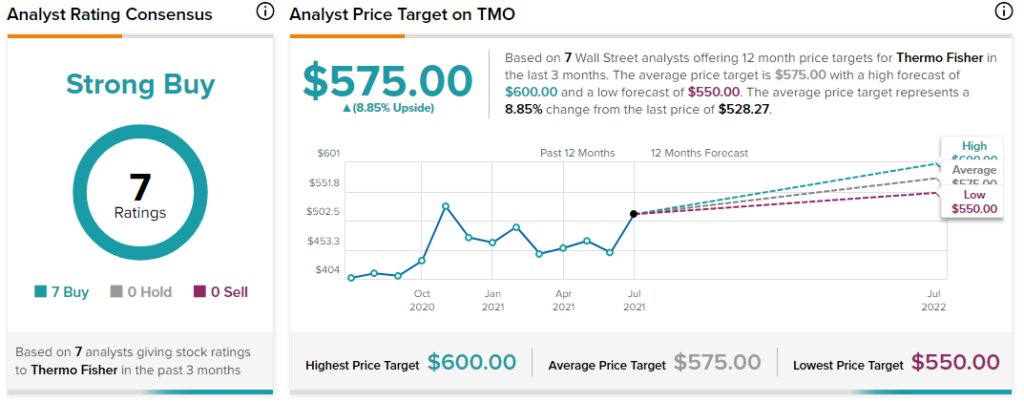

On July 16, Benchmark Co. analyst Robert Wasserman initiated coverage on the stock with a Buy rating and a price target of $580 (9.8% upside potential). The analyst said, “The company has an unrivaled combination of innovative technologies, purchasing convenience and pharmaceutical services through industry-leading brands serving science.”

Overall, the stock has a Strong Buy consensus based on 7 Buys. The average Thermo Fisher price target of $575 implies nearly 9% upside potential to current levels. Shares of the company have gained 29.1% over the past year.

Related News:

Ford Gains 3.8% on Outstanding Q2 Results; Raises Guidance

Steven Madden Reports Solid Q2 Results; Retail Revenue Outshines

Qualcomm Beats Q3 Expectations, Sets Bullish Q4 Outlook