Healthcare equipment and solutions provider Thermo Fisher Scientific (NYSE:TMO) is acquiring Sweden-based Olink Holding (NASDAQ:OLK), a leading name in proteomics solutions, in a $3.1 billion deal.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The boards of both companies have approved the $26 per share acquisition, representing a 74% premium over OLK’s closing price on October 16. Next, TMO will commence a tender offer to acquire all of OLK’s common shares and American Depository Shares.

OLK’s advanced proteomics solutions are complementary to TMO’s mass spectrometry and life sciences platforms. TMO’s operational capabilities and global footprint can potentially help OLK derive significant growth opportunities.

The transaction is anticipated to close by the middle of next year, and upon closure, OLK will come under TMO’s Life Sciences Solutions segment. Further, the deal is expected to be dilutive to TMO’s bottom line by $0.17 per share during the first full year of ownership. However, by year five, TMO expects the transaction to deliver $125 million of adjusted operating income from revenue and cost synergies.

What is the Target Price for TMO?

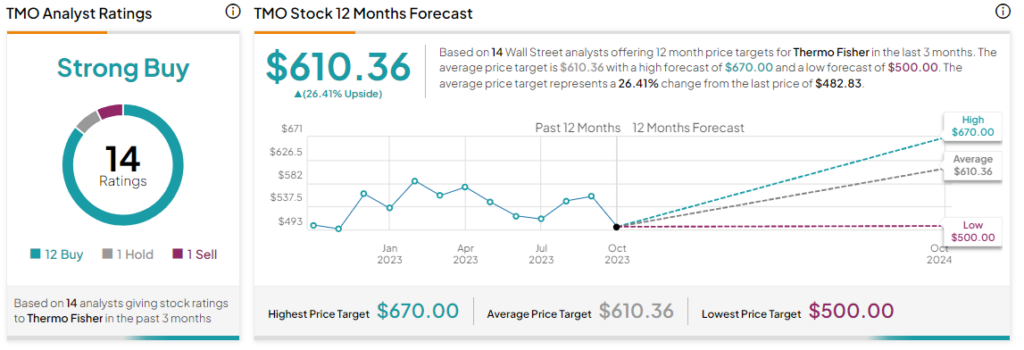

The acquisition has sent Olink shares 65% higher today, while TMO shares are trending marginally lower. Overall, the Street has a Strong Buy consensus rating on Thermo Fisher. The average TMO price target of $610.36 implies a 26.4% potential upside.

Read full Disclosure