Palantir Technologies (NASDAQ:PLTR) got caught up in the stormy weather on Friday, dropping over 5% as a wave of trade-related jitters wreaked havoc throughout the market.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Despite this recent tumble, PLTR’s share price is still up over 300% year-to-date as the AI darling has been delivering the goods left and right. The company’s revenues have been surging (breaking through the $1 billion barrier in Q2 2025, up 48% year-over-year) and its clientele has been growing (its customer count grew by 43% year-over-year).

There is, however, another side to PLTR’s sizzling gains, which is a valuation that is causing some investors to press pause. Indeed, the company’s valuations are head-and-shoulders above most of its peers.

Top investor Keithen Drury is stepping into this debate and trying to make some sense of whether PLTR is a good investment.

“I think there’s a split investment case on Palantir’s stock right now,” hedges the 5-star investor, who is among the top 3% of stock pros covered by TipRanks.

Drury notes Palantir’s exceptional revenue growth stemming from both government and commercial revenues, which form a powerful “one-two punch” that has helped propel PLTR up and away.

There also seems to be plenty of additional drivers up ahead, posits the investor. For instance, while the U.S. market is responsible for the bulk of the company’s past sales, there is vast, untapped potential for Palantir in Europe.

“Palantir has an incredible product, and its usage is growing. These types of growth stories are rare and make the stock an intriguing buy if that’s the only factor investors look at,” adds Drury.

However, PLTR’s past performance has propelled its share price into the thin air of an ultra-high valuation “that few stocks ever reach.” Drury points out that the share price is already pricing in at least five years of strong growth and robust profit margins – and that’s assuming that the company doesn’t increase its share count.

“Palantir is a phenomenal company with a great product, but with too much growth priced in, I don’t think it will be a successful investment moving forward,” sums up Drury. (To watch Keithen Drury’s track record, click here)

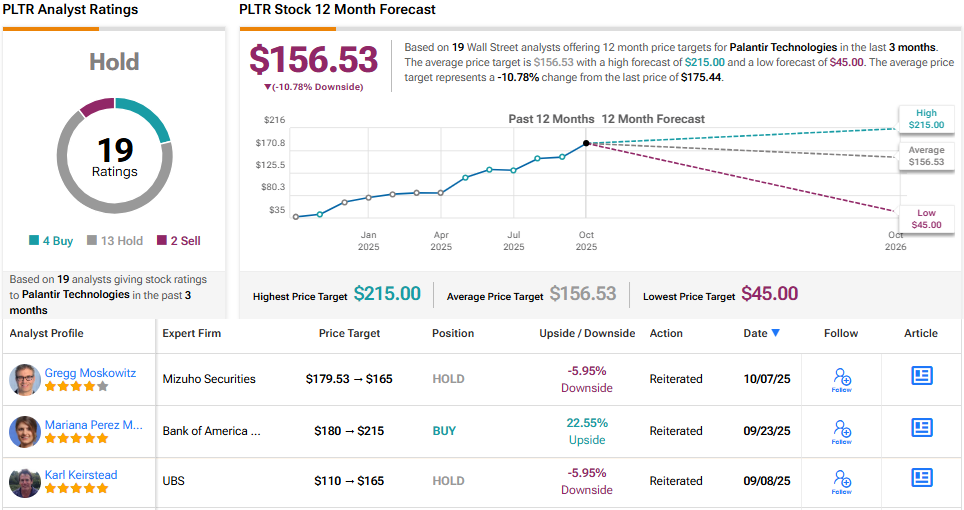

Opinions on Wall Street vary, though most analysts seem to be taking a wait-and-see approach. With 13 Holds – and 4 Buys and 2 Sells – PLTR carries a consensus Hold (i.e. Neutral) rating. Its 12-month average price target of $156.53 implies a downside of ~11%. (See PLTR stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.