The Valens (VLNS) posted a rise in sales in the third quarter of 2021, but a wider loss than in the third quarter of 2020. The British Columbia-based company produces medical and recreational cannabis products.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Net revenues came in at C$21 million in the quarter ended August 31, an increase of 15.8% from the prior-year quarter.

The company reported a gross profit of C$5.6 million in Q3 2021, down from C$7.3 million in Q3 2020.

Net loss amounted to C$12.8 million for the third quarter, compared to a loss of C$3.1 million a year ago.

The company said its provincial listings increased 37.1% quarter-over-quarter to 181 at the end of August.

Valens also noted that its beverage market share increased to 9% in the quarter from 8% in Q2, while its gross margin increased to 26.8% from 22% in the previous quarter.

Tyler Robson, CEO of The Valens Company, said: “The combination of net revenue from provincial sales and the partial quarter of revenue contribution from Green Roads represented 50% of total net revenue in Q3 2021, further illustrating the early progress on our strategic initiatives.”

The company ended the third quarter with approximately C$31 million in cash as of August 31, 2021. (See Analysts’ Top Stocks on TipRanks)

A month ago, Raymond James analyst Rahul Sarugaser reiterated a Hold rating on VLNS, and lowered his price target to C$3 (from C$3.50). This implies 42.8% upside potential.

Sarugaser is the only analyst to have rated VLNS stock in the past three months, so the average The Valens price target is C$3.

TipRanks’ Smart Score

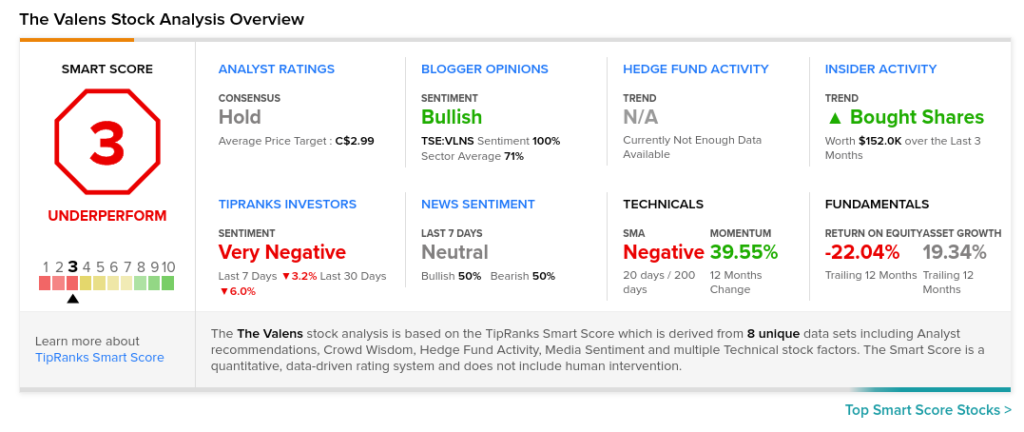

VLNS scores a 3 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock returns are likely to underperform the overall market.

Related News:

Curaleaf Closes Los Sueños Acquisition; Shares Fall

Trulieve Closes Harvest Health Acquisition; Shares Pop

Aurora Cannabis’ Q3 Sales Fall 20%; Shares Up 3%