While on the surface, things should look disastrous for online advertising platform The Trade Desk (NASDAQ:TTD), there are some unexpected signs of life therein. One of the biggest boosts came from William Blair, as the investment firm started coverage on The Trade Desk and was surprisingly upbeat. That was enough to give The Trade Desk a fractional boost in Wednesday afternoon’s trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

William Blair analyst Ralph Schackart noted that there are brighter times ahead for The Trade Desk, looking for a revenue jump of around 23% in Fiscal Year 2023. That would bring revenue up to $1.9 billion with earnings before interest, taxes, depreciation, and amortization (EBITDA) margins up to around 40%. That’s an impressive gain, especially given a difficult environment for advertisers. But what does Schackart believe will prompt such a win? The answer – transparency.

Schackart notes that The Trade Desk has made itself a very valuable property for advertisers. While some are pulling in their own wallets in the face of a consumer doing likewise, there will always be some advertising spend. The Trade Desk has put itself in an excellent position to get that market by making itself an excellent ad sales product. Clear visibility on costs and ad performance give The Trade Desk an edge that even a down market can’t completely destroy.

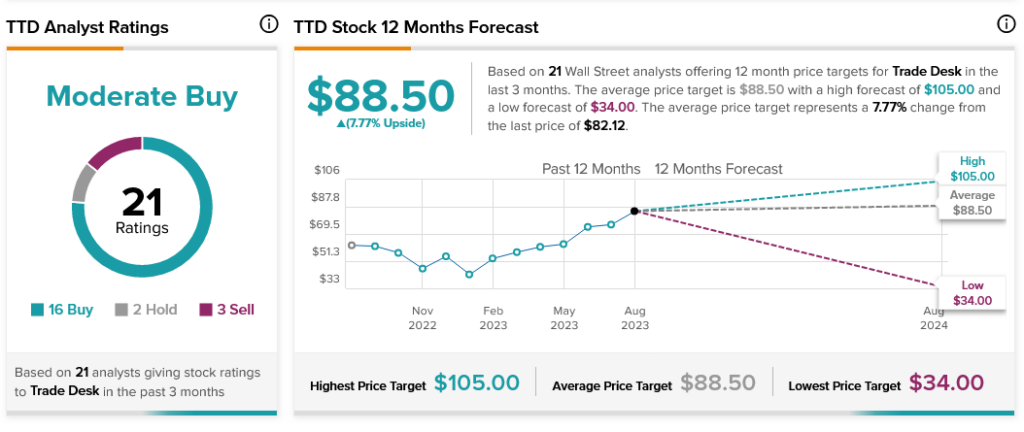

Indeed, most analysts are siding with Schackart on this one. With 16 Buy ratings, two Holds, and three Sells, The Trade Desk stock is considered a Moderate Buy. Further, with an average price target of $88.50 per share, The Trade Desk stock also comes with 7.77% upside potential.