Advanced Micro Devices (NASDAQ:AMD) stock’s Monday action is looking like one for the ages, with the semi giant on track for a blowout session. Shares took off to the tune of 27% after the company nabbed a mega deal with ChatGPT maker OpenAI.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The pair announced a multi-year agreement under which AMD will supply 6GW of chips in exchange for a warrant to purchase up to 160 million AMD shares – roughly 10% of the company. The first portion of the warrant will vest once the initial 1GW is deployed, expected in the second half of 2026 using AMD’s Instinct MI450 chips, with subsequent tranches vesting as deployments ramp to 6GW. Vesting is also tied to AMD’s stock performance, with the final tranche linked to a $600 share price. The warrant remains exercisable through October 5, 2030. AMD said the partnership could generate “tens of billions” in revenue per GW and deliver strong gross margin contributions.

Barclays’ Thomas O’Malley, an analyst ranked among the top 3% of Street stock experts, says the deal is structured to be “mutually beneficial” to both OpenAI and AMD, and “more pointedly drive the stock higher.” Job done, then, or at least, one element of it.

What makes this agreement stand out, says O’Malley, is the warrant structure, which ties issuance to each additional gigawatt deployed and to specific stock price milestones – as noted above, the final tranche requiring AMD shares to reach $600. On a quarterly basis, the deal adds about $4.5 billion in revenue on top of the $3 billion previously expected by the end of 2026. If the full 6GW is rolled out evenly through the warrant period ending in late 2030, the incremental earnings impact would be roughly $1.30 per quarter, bringing total EPS to around $3 per quarter.

O’Malley’s model assumes around 1.2GW deployed per year (6GW over five years), generating roughly $18 billion in annual revenue – based on about $15 billion per GW – and about 27 million additional diluted shares each year. The first gigawatt, expected in 2H26, could contribute roughly $15 billion in extra revenue next year.

O’Malley concedes there will likely be delays in executing these deals, given that much of the necessary infrastructure is still being built. Still, this amounts to a “proof point” of the market’s urgent need for additional compute capacity rather than a signal of share loss for Nvidia. In any case, O’Malley thinks AMD shares are unlikely to pullback from here after the huge surge.

“AMD stock is not giving this move back with the realization that more of these types of deals are likely to come (albeit smaller) over the wire through the next 6 months and the learnings from a large deployment should go miles in informing a better 500 series,” the 5-star analyst summed up.

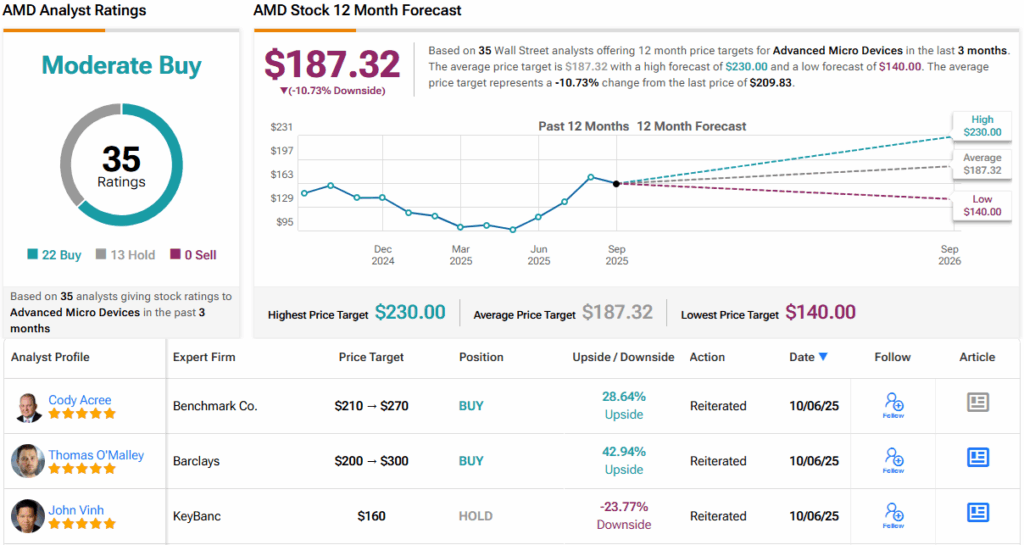

In fact, O’Malley thinks more upside is in the cards and, along with assigning AMD shares an Overweight (i.e., Buy) rating, he raised his price target from $200 to a new Street-high of $300, suggesting the stock will add another 43% from hereon in. (To watch O’Malley’s track record, click here)

The rest of the Street’s ratings break down into 21 Buys and 13 Holds, all for a Moderate Buy consensus rating. However, the $187.32 average price target now factors in a 12-month decline of ~11%. With this in mind, keep an eye out for potentially more price target hikes on the back of the OpenAI agreement. (See AMD stock forecast)

To find good ideas for AI stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.