The market for healthcare stocks in the last few years has been strange and volatile enough as it is. Now, the market for healthcare real estate, as measured by healthcare real estate investment trusts (REITs), is proving just as volatile. A recent examination of the market by Bank of America Securities proved an eye-opener for many invested in this market.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

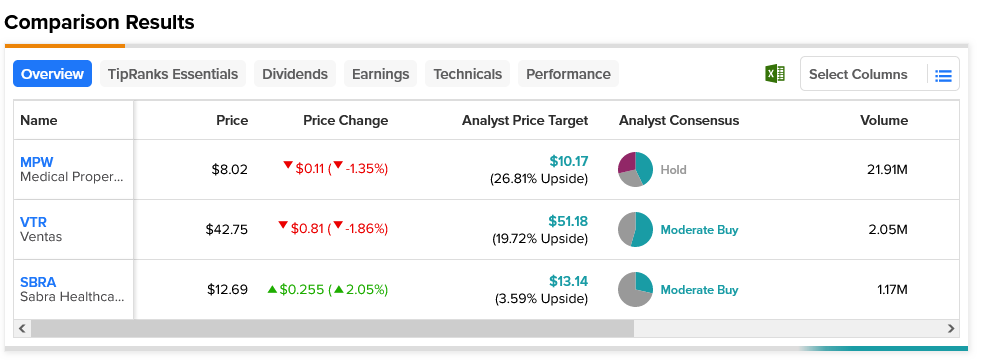

The word came out from Bank of America Securities, via analyst Joshua Dennerlein, who offered upgrades and downgrades alike. Medical Properties Trust (NYSE:MPW), for example, took one of the downgrades. As did Ventas (NYSE:VTR). However, Dennerlein offered an upgrade for Sabra Health Care REIT (NASDAQ:SBRA), which sent it up in Friday afternoon’s trading. Not surprisingly, Medical Properties Trust and Ventas both slipped in trading. Medical Properties Trust took its cut after stepping up its exposure to a riskier client, and Ventas took one after issues of independent living facilities stepped in. Sabra, meanwhile, got a hike thanks to its exposure to senior housing, which might be in for a gain.

However, one point that didn’t seem to come up was the recent discovery that medical office rents are now seeing prices that haven’t been seen in the last seven years, noted a report in the Minneapolis-St. Paul Business Journal. Moreover, other reports are pointing out how medical office buildings are defying economic cycles and offering “predictable cash flow.” Take these points together and it’s little wonder healthcare REITs are drawing investor attention.

Interestingly, while Sabra went up in Friday afternoon’s trading, it’s one of the lesser opportunities on this list. It’s rated a Moderate Buy, but with an average price target of $13.14, it can only offer a 3.59% upside potential. Meanwhile, Medical Properties Trust, rated only a Hold by analyst consensus, boasts a 26.81% upside potential thanks to its average price target of $10.17.