Tesla (NASDAQ:TSLA) shares appear to be zigzagging between the red and black in Thursday’s trading, after the company generated record revenue in Q3 while missing expectations on the bottom line.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In the quarter, revenue climbed by 11.6% year-over-year to $28.09 billion, beating the Street’s forecast by $1.39 billion, with the company benefiting from consumer purchases ahead of the expiration of the $7,500 EV tax credit on September 30.

Yet, at the other end of the spectrum, profit dropped by over a quarter as higher costs from US tariffs and heavy spending on its shift toward robotics and AI eroded margins. Adj. net income declined 29% y/y to $1.8 billion, falling shy of the Street’s forecast of $1.9 billion, while operating margins nearly halved to 5.8% from 10.8% in the year-ago period. The end result was adj. EPS of $0.50, missing consensus by $0.06.

A bright spot was the Energy Generation and Storage segment, which generated $3.41 billion in revenue – up 44% y/y and ahead of the $3.20 billion analysts called for. The strong performance was driven by growing energy storage deployments, supported by the rollout of the Megapack 3 and Megablock systems that simplify battery installations and lower costs, resulting in $1.1 billion in gross profit for the segment.

While acknowledging that it faces ongoing challenges from changing trade dynamics, tariffs, and fiscal policies, the company struck an upbeat tone regarding its AI endeavors and plans to further develop autonomous driving technology. For Wedbush’s top analyst, Daniel Ives, that is key to the bull case.

During the quarter, Tesla made steady progress on its AI strategy, with its fleet logging over 1.3 billion FSD miles and reaching a total of 6 billion miles to date, providing a “solid database to improve its FSD capabilities.” The company is also developing its AI5 chip in the US with partners Samsung and Taiwan Semiconductor, which should be able to deliver up to 40 times the performance of the current AI4 chip while being less complex, enabling faster AI improvements over time.

Tesla confirmed that Cybercab remains on track to enter volume production in 2Q26 at its Austin facility. The first production lines for the Optimus humanoid robot are being installed, with large-scale production of the Optimus V3 expected to begin in the first quarter of 2026, making 2026 a “critical year” for the company. Meanwhile, demand for Megapack and Powerwall products should stay strong into next year, driven by AI and data center needs, including from hyperscalers and utilities seeking to ease grid constraints and boost energy reliability.

“We continue to believe Tesla could reach a $2 trillion market cap in early 2026 in a bull case scenario and $3 trillion by the end of 2026 as the golden AI chapter takes hold at Tesla,” the 5-star analyst opined.

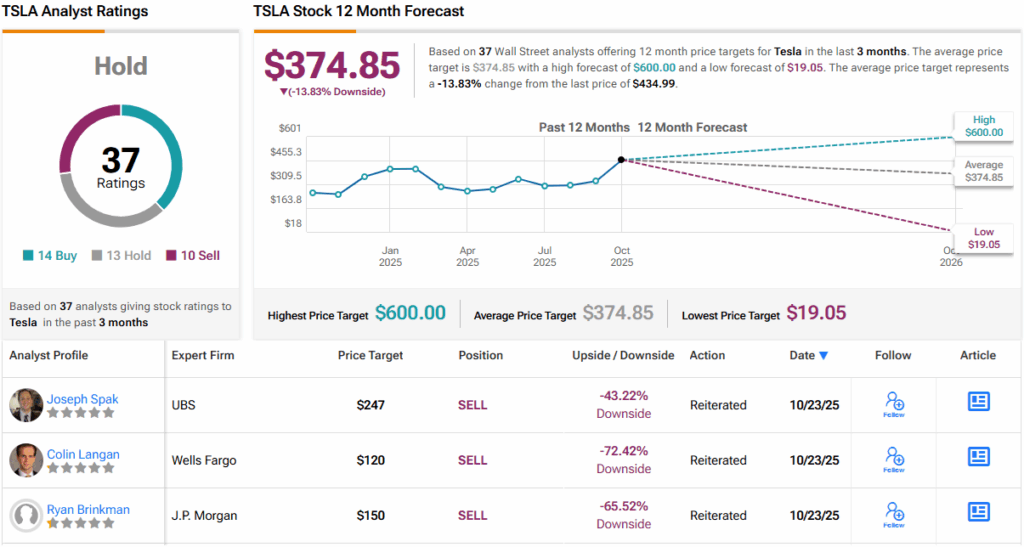

To this end, Ives assigns TSLA shares an Outperform (i.e., Buy) rating, backed by a Street-high $600 price target. The implication for investors? Upside of 38% from current levels. (To watch Ives’ track record, click here)

That’s a bull’s take, but many others on the Street aren’t quite as optimistic; the stock only claims a Hold (i.e., Neutral) consensus rating, based on a mix of 14 Buys, 13 Holds, and 10 Sells. Shares are expected to fall by ~14% over the coming year, considering the average price target stands at $374.85. (See TSLA stock forecast)

To find good ideas for AI stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.