Once upon a time—let’s say back around 1996 or so—The Gap (NYSE:GPS) was one of the leaders of clothing culture worldwide. Its stores were found in virtually any shopping mall worthy of the name, and its clothes adorned children both prosperous and desperately trying to look the same. Now, however, it’s a much different story, and The Gap lost over 9% in the closing minutes of Monday’s trading session as mall shopping started to look a little more perilous to investors and analysts alike.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

What was the problem that sent The Gap into the abyss? A downright depressing holiday sales forecast from Deloitte did that job and left no holly-jolly to be had among those trading retailer stocks. There is at least a modicum of good news, as holiday retail sales are expected to be up between 3.5% and 4.6% this year, noted Deloitte. The problem, however, is that growth was 7.6% this time last year, and there’s the not-so-little matter of inflation still dogging everyone’s heels. Though Deloitte expects inflation will moderate—which generally means “still go up but not quite so fast”—that, in turn, will drag on any kind of growth figures.

The Gap, however, will not go quietly into the chasm. Only recently, it released a line of new sleepwear and intimate apparel in conjunction with Macy’s (NYSE:M). This includes a range of products, such as some high-end pajamas that should draw plenty of interest with the colder seasons of the year on tap. Yet, even this new apparel doesn’t help in light of what we just saw out of The Gap only recently, as both in-store and online sales dropped significantly. The Gap responded well with cost-cutting measures, but costs can only be cut so far. Without a reliable customer base to buy all those clothes, The Gap will continue to struggle.

Is GPS a Good Stock to Buy?

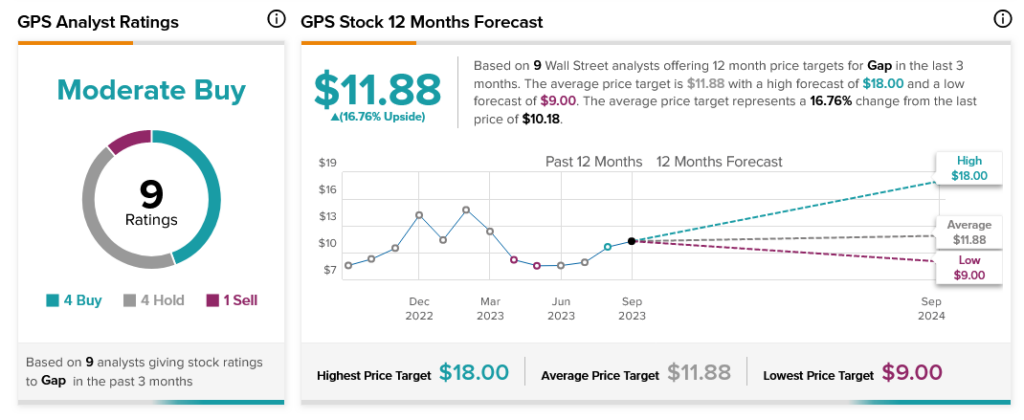

Analysts, for their part, are largely split over how well GPS stock will perform. Four Buy ratings, four Holds, and one Sell make The Gap stock a Moderate Buy by analyst consensus. Further, GPS stock’s average price target of $11.88 per share offers investors an upside potential of 16.76%.