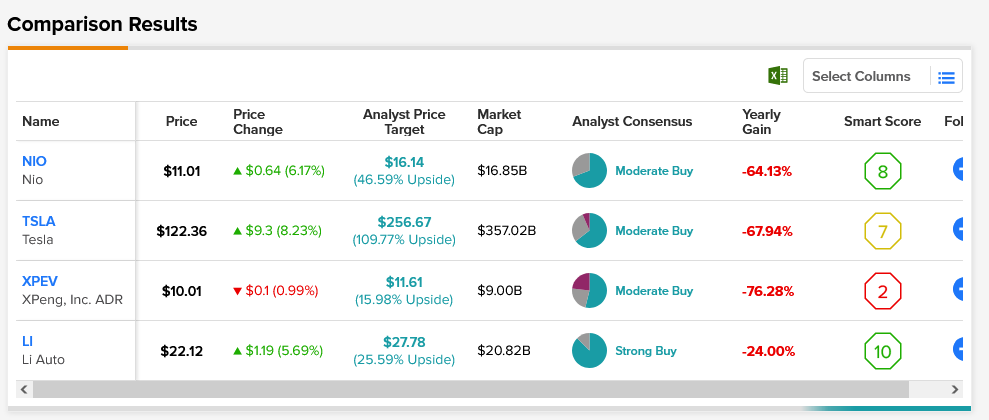

What a difference a weekend makes! Just last week, we were talking about a plunge in the electric vehicle (EV) sector. Now we’re talking about a rally in the field, brought about by some of the leading names. Tesla (NASDAQ:TSLA) is making a recovery, and both Li Auto (NASDAQ:LI) and Nio (NYSE:NIO) are joining in. Only XPeng (NYSE:XPEV) is showing signs of slowing in the midst of this new rally.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

It’s not just Tesla and most of the Chinese market that’s making a recovery. Several others are also in the hunt to make up some of the ground they lost last year. Tesla alone has plenty of troubles on this front. Over the weekend, Tesla buyers in China actually set up protests around Tesla dealerships, deeply upset that they paid full price when buyers now are getting discounts. However, the move isn’t having quite the impact Tesla hoped for. Report note that sales are still low despite discounts, even though Chinese subsidies are now out the door.

In a move that will likely prove helpful, though, lithium miners in China project a 25% drop in the price of lithium to come. Sinomine Research Group chair Wang Pingwei revealed that lithium supply is steadily increasing. That means prices will fall as well, which should help bring down prices organically and make heavy discounting less of a necessity.

Analyst consensus figures show there are clear winners and losers in the market. Though to what extent depends on how much weight you place on a figure. Tesla, for example, is considered a Moderate Buy. But it offers a 109.77% upside potential thanks to its average price target of $256.67. Meanwhile, XPeng only offers a 15.98% upside potential thanks to its average price target of $11.61.