Shares of The Container Store Group (NYSE: TCS), the retailer that offers storage and organization products, and custom closets, slumped in pre-market trading at the time of publishing on Wednesday after the company’s outlook left investors disappointed.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Looking forward, the company expects net sales in the range of $200 million to $210 million, well below the consensus estimates of $257.7 million. Meanwhile, comparable store sales are also expected to fall between 23% and 19%. Adjusted loss is projected to range from $0.16 to $0.10 per share for the quarter versus analysts’ expectations of earnings of $0.12 per share.

For the full-year, consolidated sales and adjusted earnings are anticipated to range from $885 million to $900 million and $0.21 to $0.31 per share, respectively. Consensus estimates for the two metrics stood at $1.07 billion and earnings of $0.65 per share, respectively. Comparable sales are also projected to plummet by a mid-to-high teens percentage year over year.

In the fiscal fourth quarter, the company’s sales dropped 15% year-over-year to $259.7 million while comparable store sales declined by 13.1%. Analysts were expecting TCS to post revenues of $265.72 million. Even the company’s adjusted earnings fell to $0.18 per share in Q4 versus $0.46 in the same period last year while analysts were expecting adjusted earnings of $0.16 per share.

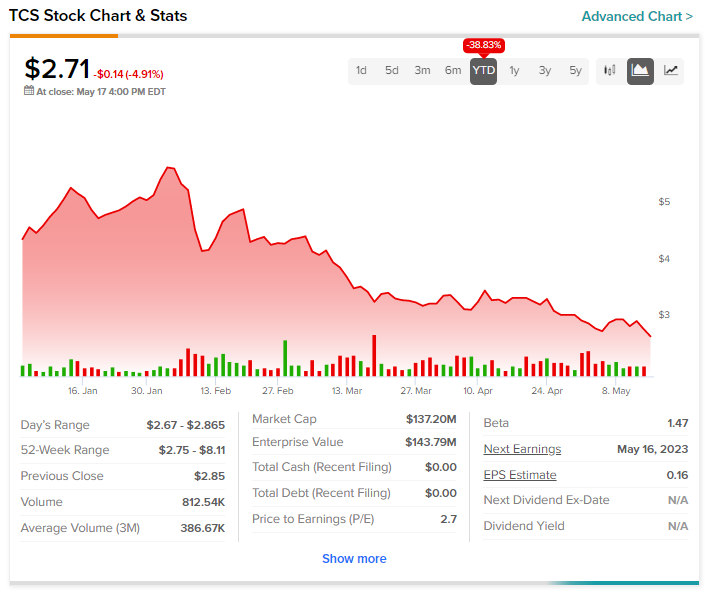

Year-to-date, TCS stock has declined by more than 35%.