It has been a rough few years for retailers. The pandemic shutdown and subsequent reopening-related supply chain issues have caused a ripple effect that has reverberated across the industry, driving many big names, like Bed, Bath & Beyond, Neiman Marcus, and GNC, into bankruptcy. Earlier this year, it looked like The Children’s Place (NASDAQ:PLCE) might be headed in the same direction, and the stock plunged.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

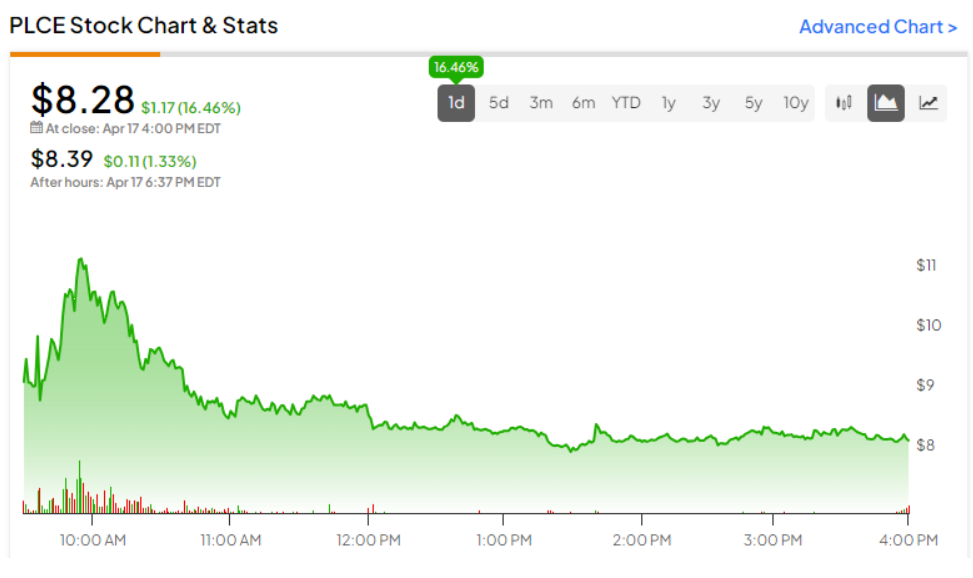

Since then, the company has had several lifelines thrown to it by Saudi-backed Mithaq Capital, with the latest $90 million in unsecured financing causing the shares to jump over 16% in a single day. However, until there is more evidence that the company has turned the corner and is returning to some semblance of profitability, the stock is a highly speculative investment that most investors would do well to sidestep for now.

Mithaq Capital: The Children’s Place’s Majority Shareholder

The Children’s Place provides high-quality and trendy children’s apparel, accessories, and footwear at value prices, primarily under its brands, such as The Children’s Place, Gymboree, Sugar & Jade, and PJ Place. It operates globally with a robust network encompassing four digital storefronts and over 500 physical stores across North America. It also has a diverse presence in the international market through collaborations with six international franchise partners, enabling distribution in 16 countries.

Mithaq Capital, the investment firm of the AlRajhi family, achieved majority ownership of The Children’s Place in the wake of the company’s announcement of an operating loss in the fourth quarter of 2023. This news caused a 58% decrease in share value. Seizing the opportunity, Mithaq Capital purchased shares in the market at a steep discount, gathering enough to become majority owners. Mithaq is set to further entrench its influence in the company by nominating 11 candidates to The Children’s Place’s board of directors at the next meeting.

PLCE’s Recent Financial Events

The Children’s Place announced a new financing deal with Mithaq Capital SPC, its majority shareholder. The agreement revolves around a $90 million unsecured, subordinated term loan. The funding of this loan will be completed no later than April 19, 2024. This new financial move is expected to bolster the company’s liquidity position.

The proceeds from this new Mithaq Term Loan will be utilized for several purposes. The company aims to pay off an existing $50 million term loan. Additionally, some funds will reduce outstanding accounts payable balances with vendors. The remaining proceeds will be used for other general corporate matters.

The market quickly responded to the news, and shares jumped in value by over 50% at one point, finishing the day up 16.46%.

Closing Thoughts on PLCE

At a time when the retail sector continues to grapple with pandemic-induced challenges, The Children’s Place stands at a crucial juncture following a rollercoaster ride in both operational performance and stock value. While other retailers have filed for bankruptcy, The Children’s Place continues to swim against the tide, primarily due to strategic financial support extended by Saudi-backed Mithaq Capital. Nevertheless, caution around the retailer’s viability as a long-term investment is warranted. It is a highly speculative turnaround, and the road to profitability remains uncertain.