The voice recognition race has finally moved beyond gimmicks and into genuine productivity. From contact centers using AI to handle routine calls, to cars that truly understand spoken commands, and enterprises integrating voice assistants into their workflows—the industry is expanding fast. While the usual giants—Microsoft (MSFT), Apple (AAPL), Alphabet (GOOGL), and Amazon (AMZN)—currently dominate the field with over 60% market share, investors seeking something a bit more distinctive (and perhaps more dynamic) have a few intriguing alternatives to explore

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

SoundHound AI (SOUN) offers a pure-play voice AI platform serving cars, restaurants, and customer service. 8×8 (EGHT) provides cloud-based phone and contact-center solutions enhanced by AI. And Cerence (CRNC) offers in-car voice technology.

For investors seeking exposure to this emerging yet indispensable market, these three relatively early-stage companies merit attention. In the evolving world of the Internet of Things (IoT)—where smart devices and ubiquitous AI converge into a single connected ecosystem—voice recognition is critical. It’s what will enable users to unlock productivity across countless devices and experiences. In that future, keyboards, mice, and touch screens simply won’t be enough.

SoundHound AI (NASDAQ:SOUN)

Among today’s three contenders, the clear leader in price performance is SoundHound, with its stock up roughly 82% over the past year. SOUN has easily been the best-performing name in the voice AI space. To support the strong sentiment, the company is showing real progress—just last week, SoundHound reported record Q3 revenue of $42 million, a 68% year-over-year increase.

Furthermore, year-end guidance was raised, with management emphasizing real-world deployments, such as voice ordering in restaurants, “smarter” car assistants, and customer service agents that actually get things done. SoundHound also sports a strong balance sheet, with $269 million in cash and no debt, which is a significant advantage if the consolidation wave continues.

What changed the story arc recently is deal-making and scope. In September, for example, SoundHound acquired Interactions for approximately $60 million in cash, describing it as immediately accretive and framing a more comprehensive “agent” stack for customer service. This software can understand intent, take appropriate action, and escalate as needed. That pulls SOUN deeper into contact-center workflows, rather than just speech recognition.

Moving forward, look for execution and margins. Note that the company has swung between celebration and hand-wringing when costs or gross margin wobble. Yes, this is typical for a fast grower building a category. However, if “action-taking” agents become the default in service operations, SOUN’s broader platform is positioned to win seats in the space, which is why I like the stock. In any case, note SOUN is still unprofitable and trades at 35x this year’s expected revenue. Any missteps could cause steep sell-offs.

Is SOUN Stock a Buy, Hold, or Sell?

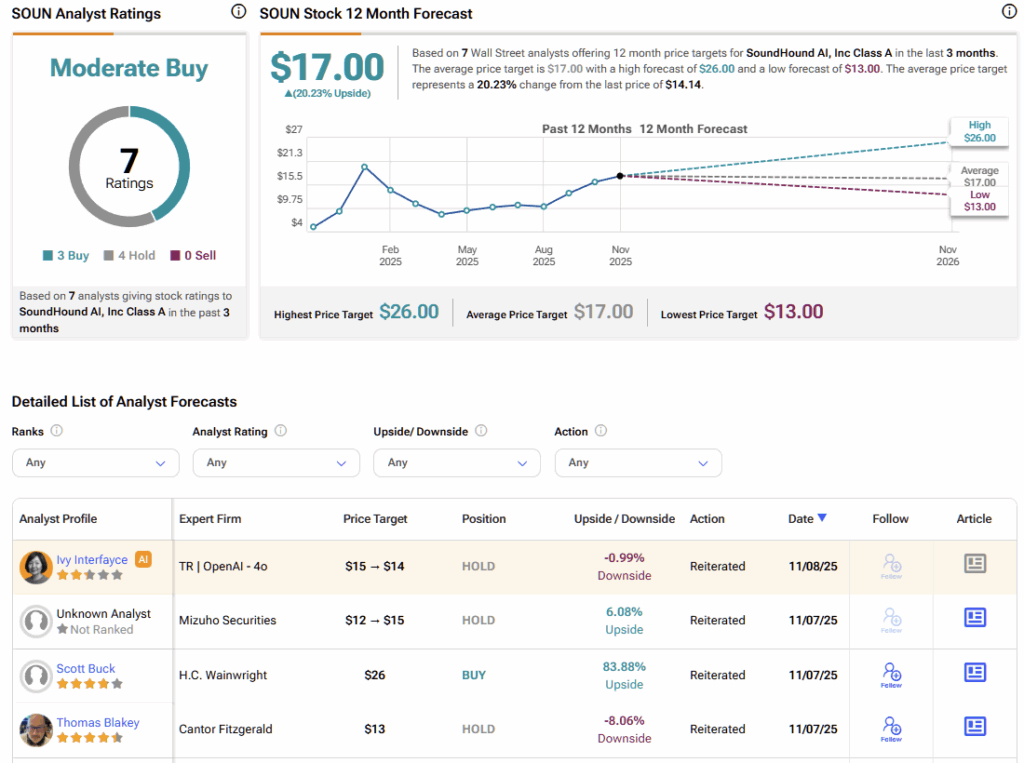

Analyst sentiment is relatively bullish on SoundHound, with the stock carrying a Moderate Buy consensus rating, based on three Buy and four Hold ratings assigned over the past three months. No analyst rates the stock a Sell. Currently, SOUN’s average stock price target of $17 implies ~20% upside potential over the next twelve months.

8×8 (NASDAQ:EGHT)

In stark contrast to SoundHound, 8×8 is down ~33% over the past 12 months, making EGHT the underdog’s underdog. Its latest print (Q2 FY26) showed soft growth and a positive adjusted operating margin, but the more interesting aspect is its strategy of selling AI features, such as call summarization, transcription, and agent assist, into the large base the company already serves for phone and contact-center software. That’s a practical path to defend revenue even as some customers churn.

Management appears to focus on cost discipline, steady debt repayment, and a contact-center mix to support margins as usage-based products expand. It’s more of a blocking-and-tackling approach rather than the moonshot most startups chase in the space, and it honestly fits a market where CIOs want incremental wins they can measure.

So why the weak stock? Well, patience is thin. Investors want faster re-acceleration, and the analyst stance skews cautious. For the setup to improve, watch for proof that AI add-ons are lifting average revenue per account and that churn in legacy voice slows. If those two needles move, the narrative could change faster than the model does. At just 0.37x this year’s expected sales and under 6x this year’s expected EPS, the business appears undervalued. Still, the lack of growth and $305 million net debt position explain the low multiples.

Is 8×8 Stock a Good Buy?

On Wall Street, 8×8 stock features a Moderate Buy consensus rating, based on two Buy and two Hold ratings, similar to SOUN. Not a single analyst rates EGHT stock a Sell. Moreover, 8×8’s average stock price target of $2.35 implies more than 22% upside potential over the next 12 months.

Cerence (NASDAQ:CRNC)

Even though it has traded flat for most of 2025, Cerence is still up ~170% YoY. The company has quietly rebuilt its credibility, helped by five consecutive quarters of positive free cash flow and a pipeline that keeps its technology inside new models. Note that Cerence already reported Q3 FY25 back in August, and while it saw revenues decline by 12%, it did post its fifth consecutive quarter of positive free cash flow.

The company is scheduled to post its Q4 FY25 on November 19. Besides revenues and free cash flow, I will be looking for stickiness and pricing power overall. Specifically, I think the market will focus on attach rates for connected voice services on 2026 model cycles, per-car royalty visibility, and how its new xUI platform (which is planned for on-device + cloud “hybrid” assistants) shows up in real OEM wins (recent showcases with Great Wall Motor (GWLLF) and partnerships like Mahindra). Automakers want branded control and data privacy, and Cerence’s pitch is “we’ll build your assistant, your way,” and I think this may have real value.

Still, there are significant risks. Big Tech wants the same dashboard real estate. If an automaker standardizes on a third-party household assistant, Cerence must prove it plays well or offers a clearly better, car-native experience. Balance the excitement about the product slate with questions on backlog quality and timing. At the end of the day, royalties only ramp as cars ship. The fact that the stock trades at just 16x next year’s expected EPS indicates the market’s skepticism regarding future growth and profitability potential.

Is Cerence a Buy, Hold, or Sell?

Currently, TipRanks is not tracking any analysts covering Cerence. However, TipRanks does track hedge fund activity on the stock. Supporting its headline-grabbing exploits, the smart institutional money seems to like CRNC.

According to TipRanks’ hedge fund tracker, CRNC is currently seen positively by hedge fund managers on Wall Street. According to 13F filings from 487 hedge funds submitted to the SEC over the past quarter, hedge fund managers have increased their stakes from almost zero in January this year to more than 1.5 million shares today. The current confidence signal based on two leading hedge funds is Positive.

Voice Recognition Enters the Results Era

The voice recognition industry has entered a results-driven phase. Businesses now prioritize reducing customer frustration, enabling safer in-car voice control, and creating workflows that actually deliver outcomes.

SOUN stands out as the leading growth-focused platform, exhibiting the strongest momentum to date. EGHT appears to be the steady operator aiming for a valuation reset, while CRNC remains the niche specialist with strong OEM partnerships. The real challenge for all of them is sustained adoption—and the latter two still have much to demonstrate before attracting a broader investor audience.