Teva Pharmaceutical (NYSE:TEVA) shares are trading higher at the time of writing, fueled by the reveal of their “pivot to growth” strategy and a favorable upgrade by Evercore ISI. The Israeli generic drug manufacturer has had a rocky few years, with revenues dwindling and debt soaring even after sorting out a nationwide opioid-related lawsuit last year. But CEO Richard Francis seems to be bullish, claiming that their new growth-centered game plan would propel Teva towards being a “stronger, bolder, and simpler organization.”

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

This revitalized strategy is built on a quartet of main pillars: commercial portfolio and biosimilars, innovation, generics, and capital allocation. Its target is to spark both short and long-term growth, and Teva was firm in reiterating its financial goals for 2027. The drugmaker also unveiled plans to broaden its sales reach across more regions to rake in over $2.5B in annual revenue from its movement disorder therapy, Austedo, by 2027.

Furthermore, Evercore analyst Umer Raffat nudged TEVA up to an ‘Outperform’ from ‘In-Line’ status. He drew attention to anticipated Phase 2 and Phase 3 results for experimental drugs, 48574 (anti-TL1A agent) and long-acting olanzapine, due next year. As Raffat put it, if either of these drugs hit the mark, it would mean a significant windfall for the equity holders.

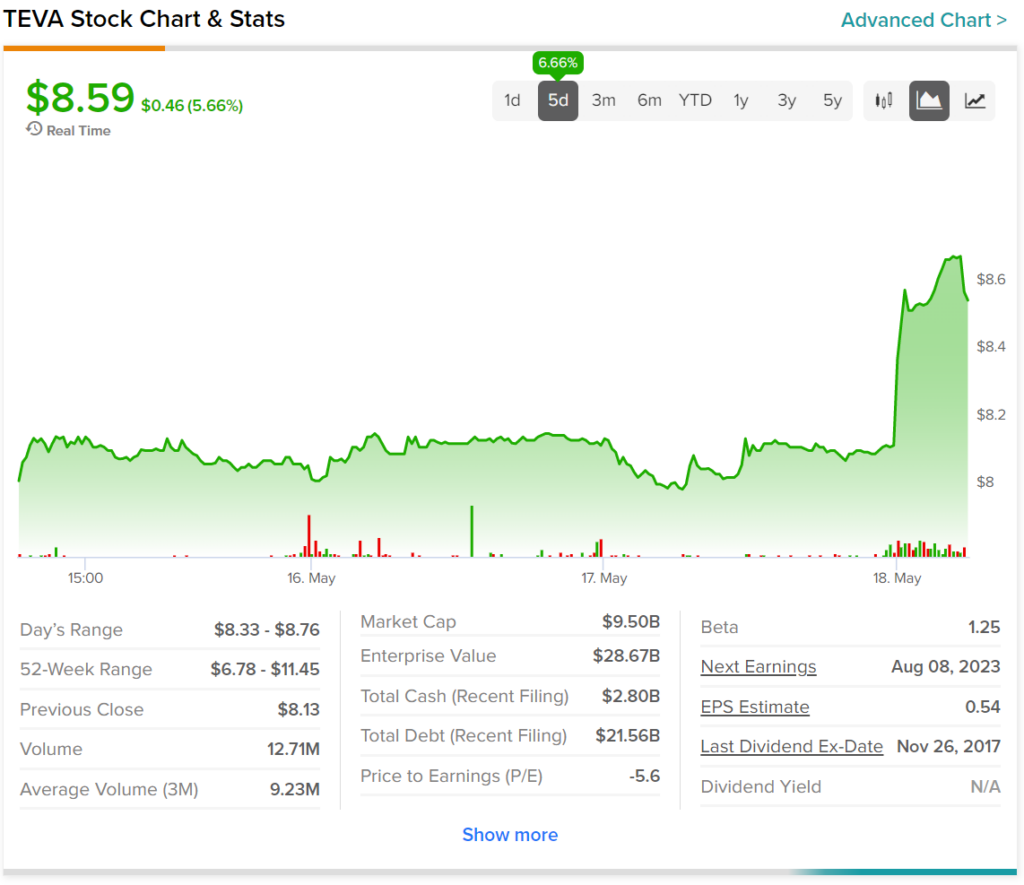

A look at the past five trading days for TEVA stock highlights the level of impact today’s news had on it. Indeed, shares jumped over 5% at the time of writing. As a result, investors are now up 6.66% during this timeframe.