Tether’s $181.2 billion reserve base and more than $10 billion in 2025 profits have fueled comparisons to a central bank. The stablecoin giant is expanding its influence across crypto markets while facing growing scrutiny over transparency and control.

Tether’s $10 Billion Year Puts It in Central Bank Territory

Story Highlights

Once dismissed as a mere dollar peg, Tether (USDT-USD) has quietly evolved into one of the most influential financial institutions in crypto. Tether holds $181.2 billion in reserves and has earned more than $10 billion in profit so far in 2025, making the world’s largest stablecoin issuer look less like a fintech startup and more like a central bank for digital assets.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Tether’s reach extends far beyond minting and redeeming its USDt token. It manages a balance sheet filled with short-term U.S. Treasurys, reverse repos, gold, and Bitcoin, earning billions in interest thanks to high rates. Its decisions now move liquidity across exchanges, shape compliance standards, and even ripple into U.S. bond markets.

Tether Expands Its Balance Sheet Like a Central Bank

Tether’s latest attestation shows $181.2 billion in reserves against $174.5 billion in liabilities, leaving $6.8 billion in excess reserves. Given that rates remain elevated, these Treasury-heavy assets have generated more than $10 billion in interest income this year, which is a level of profitability more typical of a sovereign monetary authority than a crypto company.

Critics and supporters alike now compare Tether to a “private dollar-linked central bank.” The firm issues and redeems money on demand, manages reserves through short-term U.S. debt, and profits from what resembles modern seigniorage, earning interest on assets while users hold non-interest-bearing tokens.

Tether also exerts policy-style control. It can freeze wallets linked to sanctions, shift supported blockchains, and even allocate up to 15% of profits into Bitcoin, a move that gives it balance sheet discretion rare in the private sector.

Tether Expands Its Policy Tools

The company’s reach now includes compliance and operational interventions that resemble policy levers. In December 2023, Tether began proactively freezing sanctioned wallets, including those linked to the Russian exchange Garantex. These actions immediately affect who can move dollar liquidity on-chain, mirroring how central banks influence financial flows, though in Tether’s case, enforcement replaces macro policy.

Its reserve management also functions like open market operations. By concentrating holdings in Treasurys and repos, Tether supports high liquidity and earns steady returns while maintaining flexibility for redemptions. Its quarterly attestations show this mix has created a multibillion-dollar profit buffer and steady inflow into U.S. debt markets.

Tether Diversifies into Infrastructure and Energy

In 2024, Tether formalized its expansion beyond stablecoins into four divisions: Finance, Data, Power, and Edu. Through these arms, it invests in AI projects like Holepunch, renewable energy through Volcano Energy in El Salvador, and educational initiatives to grow blockchain literacy.

These moves change Tether’s identity from an issuer to a crypto infrastructure company, one that supplies both digital liquidity and physical power to sustain the ecosystem. Its involvement in a 241-megawatt wind and solar project, built to power Bitcoin mining and payment networks, cements that dual role.

Tether’s Limits Expose the Difference Between Banks and Blockchains

Despite its central bank-like operations, Tether remains a private company with no public mandate, no lender-of-last-resort power, and no sovereign backing. Its transparency depends on quarterly attestations rather than full audits, a gap that continues to fuel debate about accountability.

The firm also holds secured loans, an asset class that raises eyebrows given its size and the lack of disclosed terms. And while its compliance policies have frozen over $835 million linked to illicit activity across 45 jurisdictions, the focus remains reactive enforcement, not economic stabilization.

Tether Is Like a Private Central Bank without the Mandate

Tether now sits at the center of the global crypto economy, issuing dollar liquidity at a scale comparable to small sovereigns. It controls supply, earns interest on national debt, and makes decisions that move billions in seconds.

Yet, for all its scale, it operates without the guardrails of a central bank: no audit, no public oversight, and no safety net. Whether this experiment continues to mirror monetary policy or diverges into something entirely new will depend on two things: how it manages risk and how regulators respond to its growing resemblance to the financial institutions it once aimed to replace.

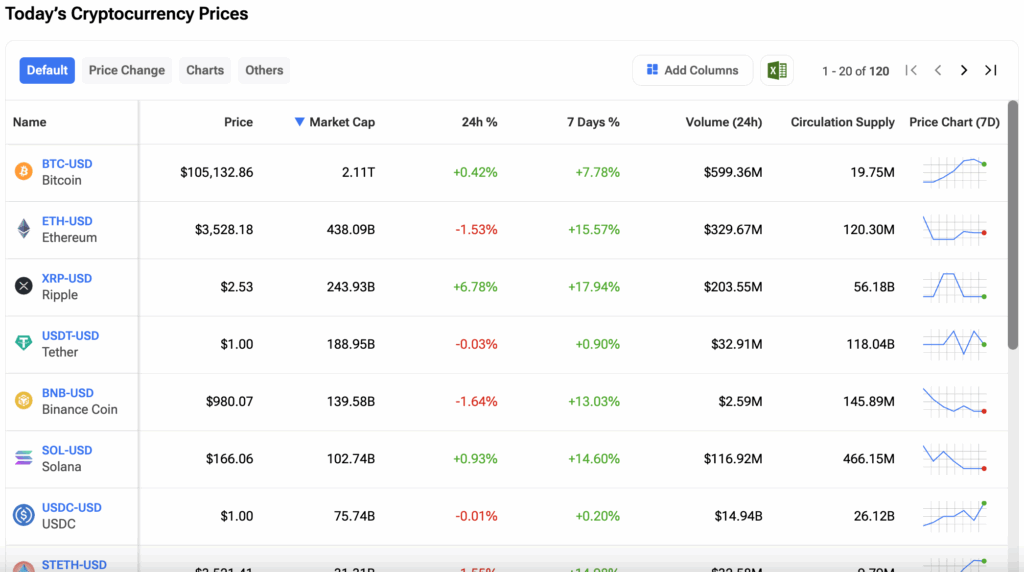

Investors can track the prices of their favorite cryptos on the TipRanks Cryptocurrency Center. Click on the image below to find out more.

1